With 82% of U.S. workers now receiving their wages through direct deposit (as of 2023) and 94% preferring this method, the need for efficient payroll management is greater than ever. In spite of this, managing payroll efficiently is still a challenge for many organizations.

That’s where Checkwriters comes in.

Our customer-centric HR and Payroll solution offers a straightforward, direct deposit setup, making it simple, compliant, and secure. In this guide, we’ll show you how easy it is to set up direct deposit, complete with our best practices for first-class payroll management.

Quick Summary

This article provides a five-step guide for setting up direct deposit for employees using Checkwriters. It covers how to choose a reliable payroll provider, gather employee information, enter data into the payroll system, create a payment schedule, and process your first direct deposit. We highlight best practices like clear communication, regular transaction reviews, and security to enhance payroll management.

Why Listen to Us?

We have been in the payroll industry for over 30 years, making us a trusted provider for organizations of all sizes. We understand payroll’s complex regulations, and our expertise means we deliver accurate, reliable advice with our solutions every time. Plus, our automated system helps to reduce payroll errors by up to 50%,

5-Step Guide for Setting up Direct Deposit for Employees

- Choose a Reliable Payroll Provider

A dependable payroll provider is key to a smooth direct deposit setup. The right provider simplifies setup, guarantees compliance, and enhances payroll efficiency.

When choosing your provider, consider the following:

- Compliance with regulations: Your provider should stay up to date with wage laws across all states, ensuring your organization remains compliant despite frequently changing rules.

- Security measures: Consider a provider with robust security protocols, such as encryption and regular audits, to protect sensitive employee data from breaches and fraud.

- Efficiency and cost savings:Automating payroll reduces admin tasks, errors, and paper check costs—ideal for nonprofits needing to stretch resources.

Additional features like integration and customization options can make a difference, too. Checkwriters, for instance, provides robust HR automation tools , offers integration with your accounting systems, and includes an employee self-service portal, a feature that 92% of employees in one survey say they prefer.

- Gather Required Employee Information

When setting up direct deposit for employees, you must collect specific information to ensure the process runs smoothly. Here is the essential employee information required:

- Bank or credit union name: The financial institution where the employees want their paycheck deposited.

- Account number: The unique number identifying the employee’s bank account.

- Routing number: A nine-digit code identifying the bank’s location, necessary for directing deposits correctly.

- Account type: Whether the account is a checking or savings account.

- Employee’s name and address: For verification and record-keeping purposes.

- Direct deposit authorization form: A signed form from the employee authorizing the employer to deposit funds electronically into their account.

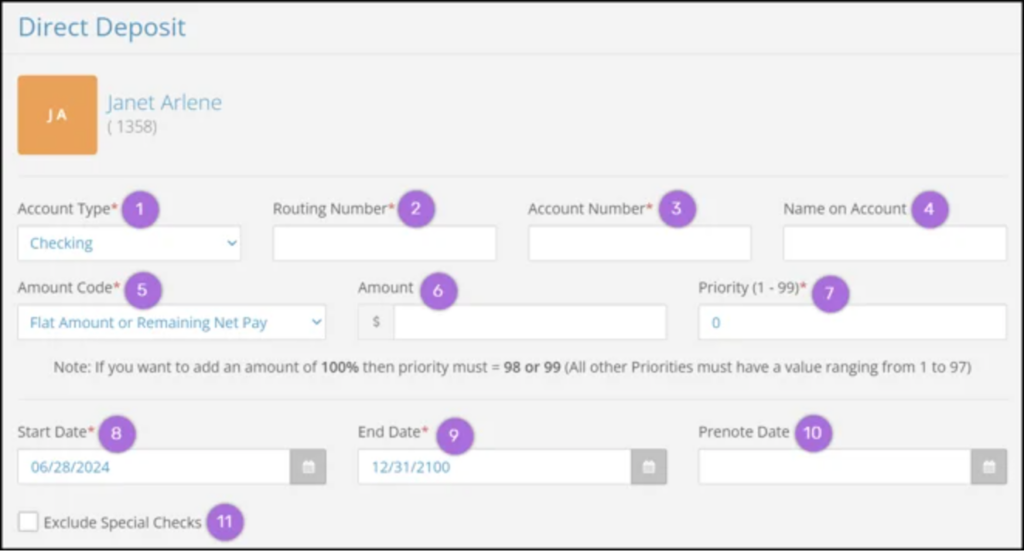

With Checkwriters, your employees can securely enter their information and authorize direct deposit through a protected online portal, minimizing the risk of unauthorized access. Our digital submission process ensures that sensitive information is encrypted and handled with the highest security standards.

Employees can also make certain changes to their direct deposit settings using our Employee Self-Service (ESS) portal. Here, they can submit requests to add or change their direct deposit details, which an admin reviews.

- Enter Employee Information into the Payroll System

Entering accurate employee information into a payroll system is essential for successful payroll processing. Checkwriters ensures all sensitive data is securely stored and readily accessible.

Additionally, we offer features like automated data validation and integration with other HR systems, helping to minimize errors and simplify the overall payroll management process. This makes it easy for employers to handle direct deposit setups while maintaining high data security and accuracy standards.

- Create a Payment Schedule

Creating a practical payment schedule involves several key considerations.

Cash Flow Management

Aligning the payroll schedule with your organization’s cash flow ensures funds are available when needed. This is particularly key for non-profit organizations, which may have variable funding sources and must carefully manage financial resources.

Compliance with Regulations

Ensure the payroll schedule complies with federal and state labor laws, which can dictate minimum pay period frequencies. Non-profits must also adhere to specific reporting requirements and deadlines, which differ from those of for-profits.

Employee Preferences

Consider employee’s preferences regarding pay frequency. Some may prefer more frequent biweekly or monthly payments to help with personal financial planning.

Administrative Capacity

Evaluate the capacity of your administrative team to handle the chosen payroll frequency without compromising other responsibilities.

Once the payroll schedule is established, Checkwriters offers several payroll automation features that keep transactions on schedule, managing hassle-free direct deposits, such as:

- Priority and amount codes: Our platform allows administrators to set priorities for direct deposits, ensuring funds are allocated according to specific rules. This includes setting up primary accounts with a priority system to manage multiple deposits effectively.

- Automated scheduling: We automate payroll scheduling, guaranteeing that payments are processed consistently on predetermined dates without manual intervention. Automation helps maintain regularity and reliability in payroll processing.

- Test Run Your First Direct Deposit

Conducting a test run on our platform helps verify that all direct deposit details are accurate and functioning as intended before the first payroll cycle. This step ensures any errors are identified and corrected early, preventing potential payment issues for employees.

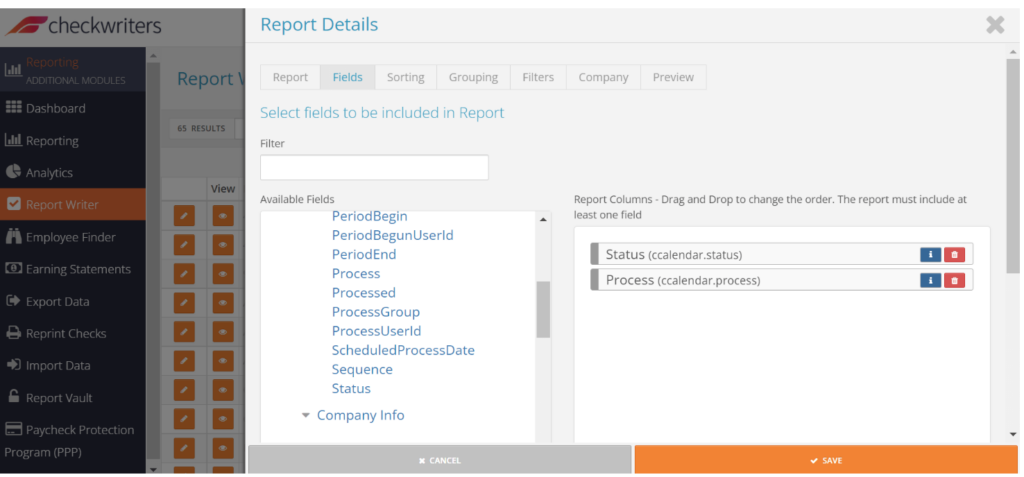

Our real-time payroll preview lets you review and confirm all direct deposit details before initiating the first transaction. Moreover, we generate detailed payroll reports so you can track completed payments, taxes, and other deductions.

Direct Deposit Set Up Best Practices

Communicate Clearly with Employees

Effective communication ensures employees understand the direct deposit process, timelines and any necessary actions.

The Checkwriters ESS portal allows employees to easily update their information, review deposit details, and stay informed of any changes in payroll schedules or direct deposit processes.

Schedule Direct Deposit on a Consistent Pay Cycle

Scheduling direct deposit on a fixed pay cycle helps employees manage their finances effectively and builds trust with your team.

Regularly Review Payroll Transactions

Regularly reviewing payroll transactions helps identify discrepancies early, ensuring accurate payments and compliance with regulations.

Stay Informed About Regulations

Payroll regulations evolve frequently. Keeping informed about regulatory changes will help you keep up to date so your organization can remain compliant.

Check out our comprehensive News & Compliance Center for resources and state and federal updates.

Optimize Direct Deposit Configurations

Setting up direct deposit configurations enhances efficiency, reduces processing errors, and ensures on-time payments.

Checkwriters’ features like priority setting and amount codes accommodate flexible payroll management by enabling configurations such as setting a primary account to receive 100% of net pay.

Maintain Accurate Employee Records

Keeping up-to-date employee records to ensure precise payroll processing and compliance with legal and tax obligations.

Checkwriters supports the upkeep of precise employee records through our comprehensive payroll and HR suite, which includes features like the ESS portal, the ability to equip documents with tracking and e-sign, and secure electronic document storage.

Offer Direct Deposit as Part of a Flexible Payment Plan

Offering direct deposit as part of a flexible payment plan provides employees with convenience and security, allowing them to access their funds quickly and reliably. The Checkwriters platform even accommodates employee paycards for employees without bank accounts.

Enhance Payroll Efficiency with Checkwriters

Setting up direct deposit with Checkwriters couldn’t be easier. We simplify payroll management by taking care of compliance and security, providing advanced features like automated scheduling and real-time payroll previews to minimize errors and streamline payroll processes. Get started with us by requesting a meeting to explore how our solutions can transform your payroll operations.