As a payroll and tax service provider, Checkwriters occasionally receives calls from employers forwarding questions they’ve had from their employees regarding tax withholding and potential money owed to the IRS. Of course, this situation can quickly become a burden for business owners, payroll and HR departments, and business offices – especially if the answer isn’t immediately clear.

The answer is often found in how dependents are calculated on the new Form W4.

Beginning in 2020, the IRS rolled out a new Form W4 that allows an employee to claim dependents differently than in years prior. On Forms W4 for years 2019 and prior, an employee would claim dependents using a number (e.g. Four [4] dependents). On Forms W4 for years 2020 and forward, an employee has the option to claim dependents using a dollar amount.

In prior years, employees would get a larger tax credit after filing taxes. However, this new W4 calculation process allows for more employees to retain a larger amount of their paycheck throughout the year, and therefore less of a tax credit after filing taxes.

Checkwriters cannot advise an employee on how to fill out the Form W4. However, we can certainly provide information to assist employers in explaining to their employees how and why certain items are calculated.

The below information should help both you and your employees.

Resources:

IRS Publication 15 >> (Note the wage bracket method on pages 8-21, which is a reliable estimator of what a given employee will have taken from their checks)

Example:

Joe Smith is paid weekly and has $1,500.00 in taxable wages for Federal Income Tax (FIT). His Form W4 states he files “Married” and claims $2,000.00 for his dependents.

The $2,000.00 is what the IRS sees Joe Smith should receive for a tax credit for claiming a dependent.

Take the dependent amount and divide by the number demonstrating employer pay frequency (weekly, bi-weekly, etc.).

$2,000.00 / 52 (weekly) = $38.46 << this is the amount of a tax credit he should receive each week

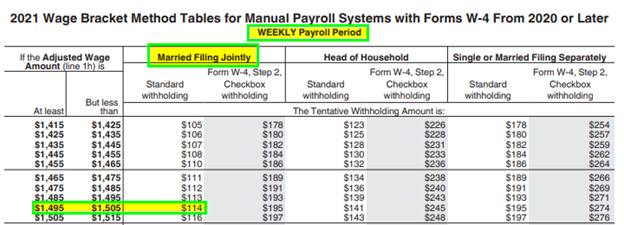

Next, take a look at IRS publication 15 – wage bracket method, based on his taxable income, pay frequency, and filing status.

Based on the table below, approximately $114 should be withheld each pay period

*this does not account for the $38.46 credit above*

Take the $114 less the $38.46 and Joe Smith should have approximately $75.54.

*this amount is solely based on his taxable wages of $1,500.00*

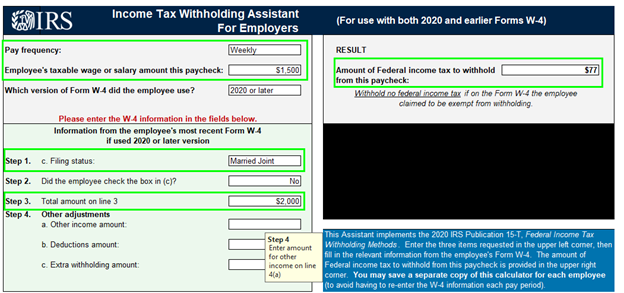

If we plug these same numbers for Joe Smith into the IRS calculator, the difference is merely $1.46.

Disclaimer: The information contained herein is not intended to be construed as legal advice, nor should it be relied on as such. Employers should closely monitor the rules and regulations specific to their jurisdiction(s) and should seek advice from counsel relative to their rights and responsibilities.