Quick Summary

In this article, we review the 12 best payroll automation software options to help organizations streamline their payroll processes and enhance efficiency. We cover the key functions of payroll automation software, how it simplifies your operations, and the benefits it brings, including enhanced accuracy, reduced processing time and improved employee satisfaction.

Ready to Explore Payroll Automation?

Are you still managing payroll manually, spending time and resources on tasks that sometimes result in errors? If the answer is yes, then it’s time to ditch that manual payroll management.

Here’s where payroll automation comes in. According to the American Payroll Association, payroll automation has the potential to reduce processing costs by up to 80%. Payroll automation also saves time and helps reduce mistakes by streamlining wage calculations, tax filing, and benefits management..

Ready to make the switch? In this Checkwriters guide, we’ll walk you through the best payroll automation tools, helping you find the right solution for accurate and efficient employee compensation and HR management.

Why Listen to Us?

With over 30 years in payroll, we’ve become a trusted partner for organizations of all sizes. Our extensive experience with payroll complexities, regulatory requirements, and compliance standards enables us to provide accurate, reliable support, making payroll simpler and more efficient for your business.

What is Payroll Automation Software?

Payroll automation software is a tool that helps you manage all payroll processes, from wage calculation to tax filing and benefits management. It reduces human input in the payroll management workflow, ensuring accuracy, compliance and resource savings.

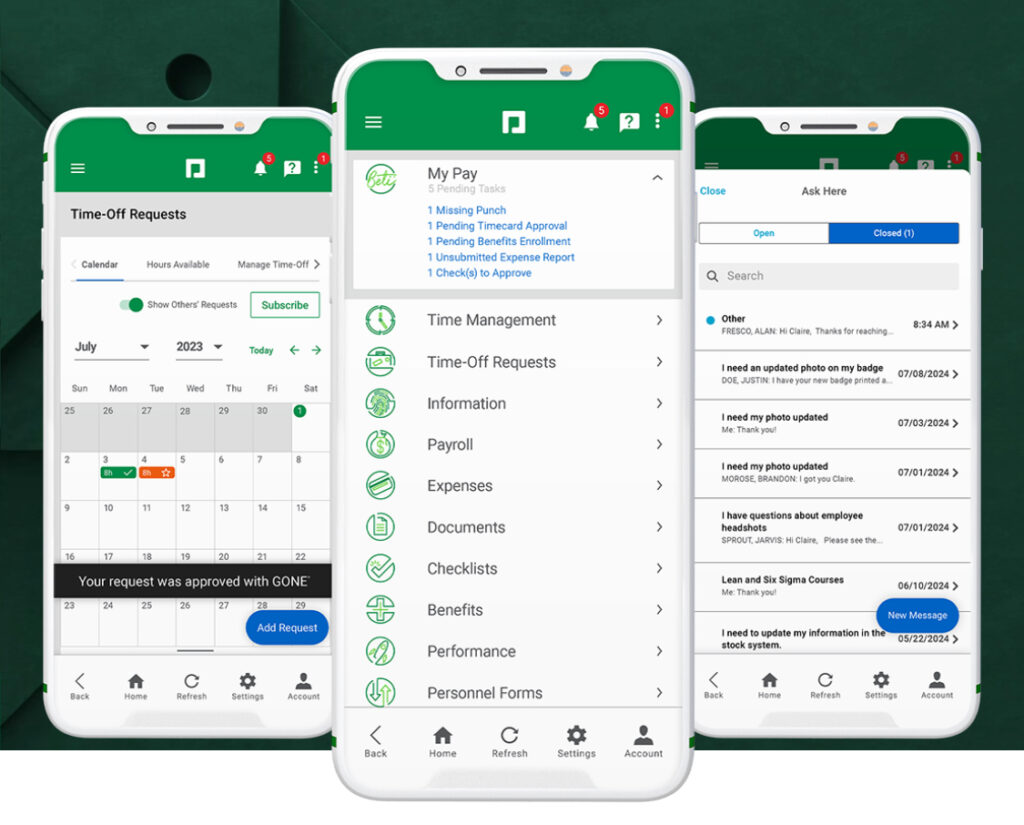

Checkwriters, for example, is a payroll and HR platform that handles every aspect of payroll processing, from automated tax filing to compliance support. With Checkwriters, you can manage payroll and other HR processes seamlessly, and our mobile app allows employees and managers to access payroll information in real time.

The Diocese of Baker, for example, streamlined their payroll processes and saved hours of administrative work every week after adopting Checkwriters’ all-in-one platform.

12 Best Payroll Automation Software in 2025

- Checkwriters: Best for integrated HR and Payroll functions, usability, and support

- Paycom: Best for enterprise-level automation and compliance

- Paylocity: Best for user engagement

- Paycor: Best for comprehensive workforce management and analytics

- BambooHR: Best for HR management within SMBs

- Gusto: Best for affordable payroll solutions

- Namely: Best for customizable HR solutions

- ADP: Best for global payroll services

- Paychex: Best for scalable payroll

- QuickBooks Payroll: Best for Small Business Integration

- Deel: Best for international payroll and compliance for remote teams

- Rippling: Best for custom payroll solutions tailored to business needs

1. Checkwriters

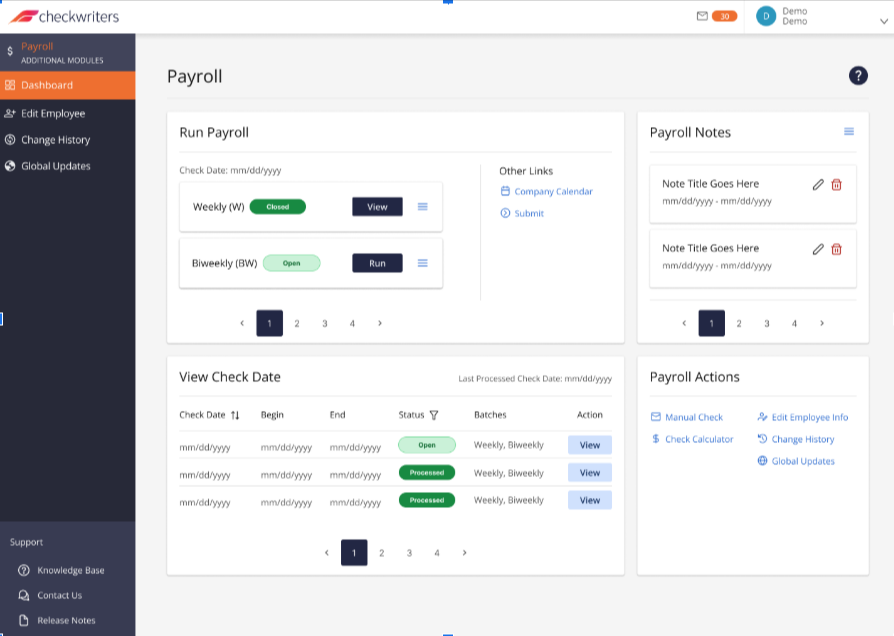

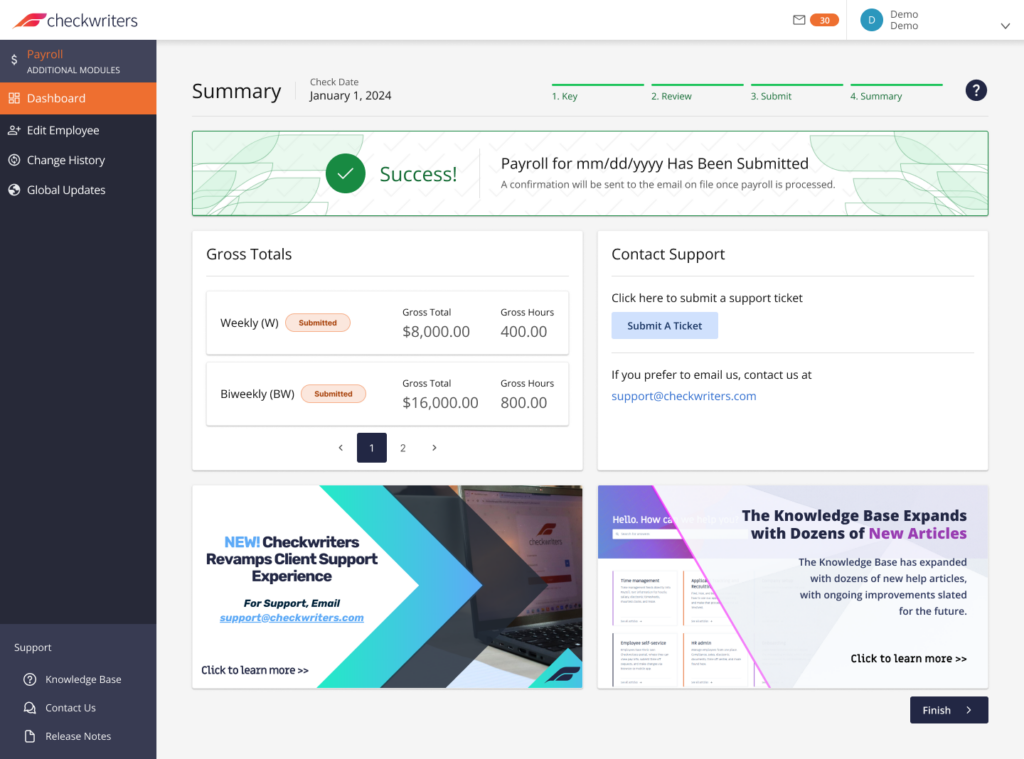

Checkwriters is an all-in-one payroll and human resources platform that automates payroll functions and supports additional HR tasks like applicant tracking, onboarding, attendance and more. Designed for flexibility, our solution streamlines these processes for all types of organizations, ensuring accuracy and compliance with relevant regulations.

With Checkwriters, you’re in safe hands. Our customer-focused approach means we prioritize what matters most to you—like seamless wage calculations, accurate tax filing, compliance updates, and top-rated customer service. When it comes to payroll automation, Checkwriters is a solution you can rely on.

Key Features

- Payroll Processing: Handle wage calculations, tax deductions and direct deposits seamlessly, reducing manual intervention.

- Applicant Tracking: Manage job applications and candidates within the system to streamline recruitment.

- Onboarding: Digitally onboard new hires, from paperwork completion to training modules, all within one platform.

- HR Automation: Streamlines HR processes by offering comprehensive tools for time-off tracking, electronic document management with e-signatures, and compliance support.

- Attendance Tracking: Keep track of employee hours and attendance with automated reports that sync with payroll.

- Mobile App: Employees and managers can access payroll and HR services on the go.

Pricing

Request a Checkwriters demo for more details and a custom quote.

Pros

- Customer-centric support, with dedicated payroll assistance and tax filing

- Streamlines HR processes, ideal for non-profits, schools and private companies

- Comprehensive payroll and HR automation tools

Cons

- May require additional customization for large organizations

2. Paycom

Paycom is a cloud-based HR and payroll platform that automates payroll tasks while integrating HR management tools.

It offers solutions for big and small businesses, helping them manage the entire employment life cycle.

Key Features

- Automatic Payroll Processing: Automatically calculate and process payroll, including taxes and deductions.

- Time Management: Track employee hours, syncing data directly with payroll.

- Talent Management: Includes tools for recruitment, onboarding and employee performance reviews.

- Compliance: Ensures compliance with evolving regulations through automatic payroll settings.

Pricing

Contact the Paycom sales team for a quote.

Pros

- HR tools include performance management, time tracking and benefits administration

- Automation for tax filing and compliance

- Suitable for medium-to-large businesses

Cons

- Complex setup for smaller organizations

- Customer support can be slow at times

3. Paylocity

Paylocity is an all-in-one payroll and HR platform that automates payroll processing while offering advanced features like performance management and employee surveys.

Key Features

- Automates Payroll: Calculate and distribute employee wages with ease.

- Integrates HR Functions: Connect payroll with other HR tasks like benefits and performance tracking.

- Employee Engagement Tools: Use surveys and feedback tools to boost employee satisfaction.

- Mobile Access: Access payroll and HR services from anywhere with a mobile app.

Pricing

Request a demo of Paylocity’s payroll software solutions to get a tailored pricing plan.

Pros

- Full integration with HR management systems

- Employee engagement tools

- Comprehensive compliance management features

Cons

- Can be too feature-heavy for smaller organizations

- Higher pricing for advanced features in comparison with other competitors

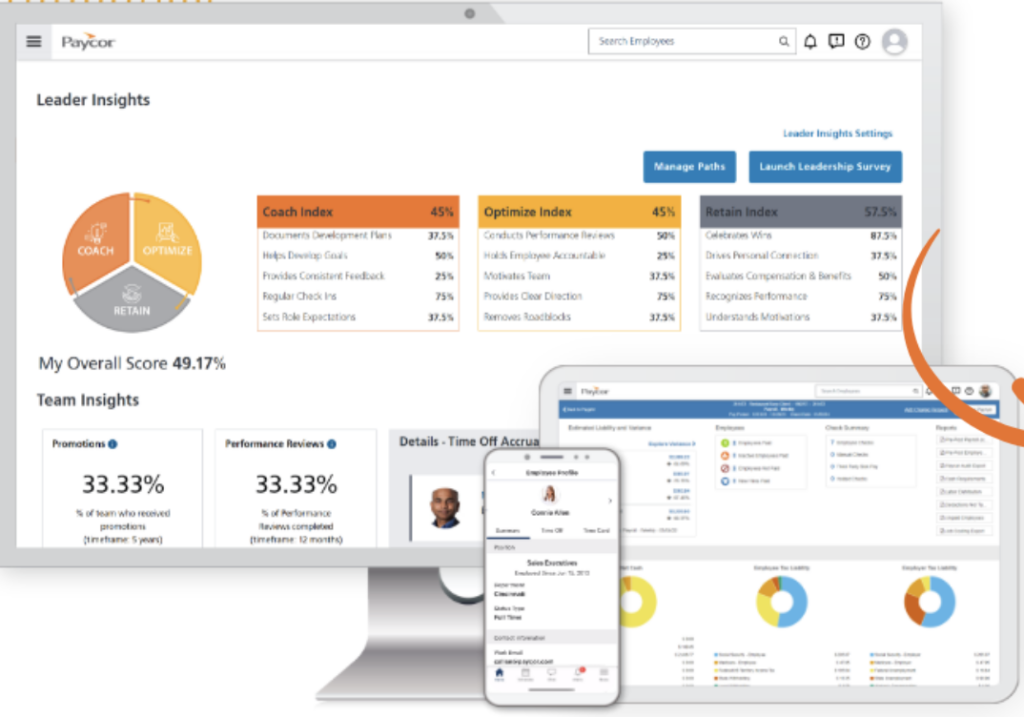

4. Paycor

Paycor offers cloud-based payroll and HR software that supports payroll processing while offering data-driven workforce management.

Key Features

- Payroll Automation: Streamline payroll processing with automated wage calculations, tax filing and compliance tracking.

- Time and Attendance Management: Tracks time, syncing with payroll to ensure accuracy.

- Recruitment Tools: Facilitates hiring and onboarding with recruitment-focused tools.

- Benefits Management: Manages employee benefits, including enrollment and updates.

Pricing

Fill out the questionnaire on Paycor’s website to get a custom price quote (if your company is a small organization) or view the platform’s mid-market product plans.

Pros

- User-friendly interface

- Comprehensive reporting for data-driven decisions

- Strong support for small to medium sized organizations

Cons

- Limited customization options

- Customer support could be more responsive

5. BambooHR

BambooHR is known for its intuitive interface and focuses on simplifying payroll and HR for small to medium businesses.

Key Features

- Payroll Processing: Automate tax calculations and employee payments.

- Onboarding: Onboard employees quickly with digital forms and training modules.

- Performance Tracking: Use performance tracking tools to monitor employee growth and development.

- Benefits Management: Manage employee benefits easily through an integrated system.

Pricing

Bamboo HR provides two main price tiers based on the number of features required: Core and Pro. Various add-ons such as benefits administration and time tracking can also be included in your package.

Pros

- Intuitive design and user interface

- Designed with small businesses in mind

- Comprehensive HR support

Cons

- Limited payroll customization for larger businesses

- Lacks some advanced features offered by larger platforms

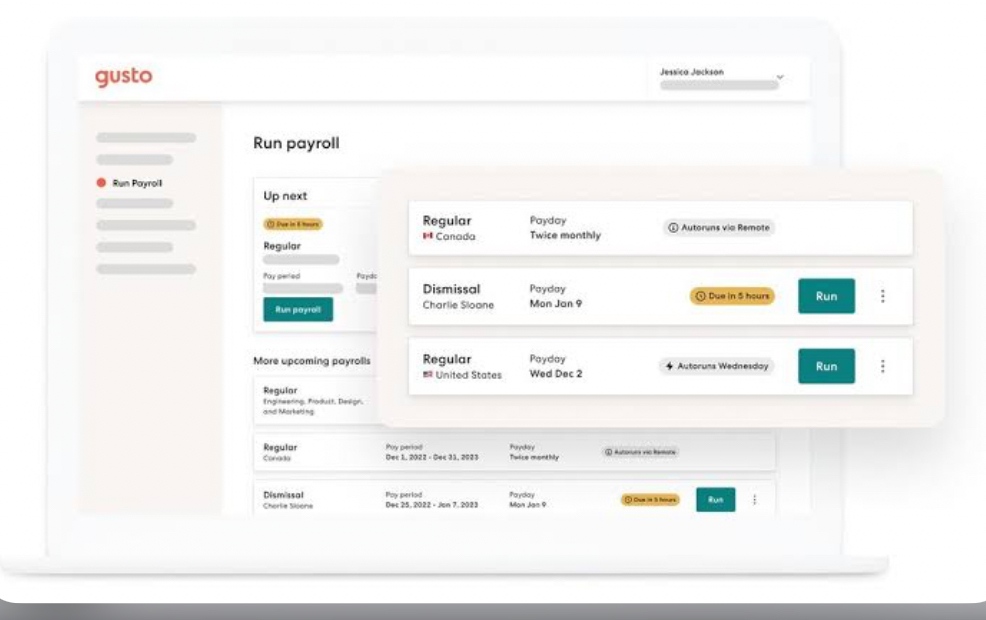

6. Gusto

Gusto is a cost-effective payroll solution designed to meet the specific needs of startups and small businesses.

Known for its comprehensive interface, Gusto simplifies payroll by integrating HR functions, tax filings, and benefits management, providing an all-in-one solution for growing teams.

Key Features

- Payroll Processing: Automatically calculate salaries, deduct taxes and file necessary forms at the local, state, and federal levels.

- Benefits Management: Administer employee health insurance, 401(k) plans and other perks directly from the platform.

- Time and Attendance Tracking: Track employee work hours, PTO and overtime, syncing this data into payroll for accurate payments.

- Onboarding: Digitally onboard new employees with tax forms, direct deposit setups and benefits enrollment in one workflow.

Pricing

Gusto offers three plans—Simple, Plus, and Premium—starting from $40 per month plus $6 per employee.

Pros

- Affordable pricing, making it ideal for startups and small businesses

- Easy-to-navigate interface with automation features

- Effective benefits management

Cons

- Limited customization making it unsuitable for complex payroll needs

- Less robust reporting capabilities compared to larger platforms

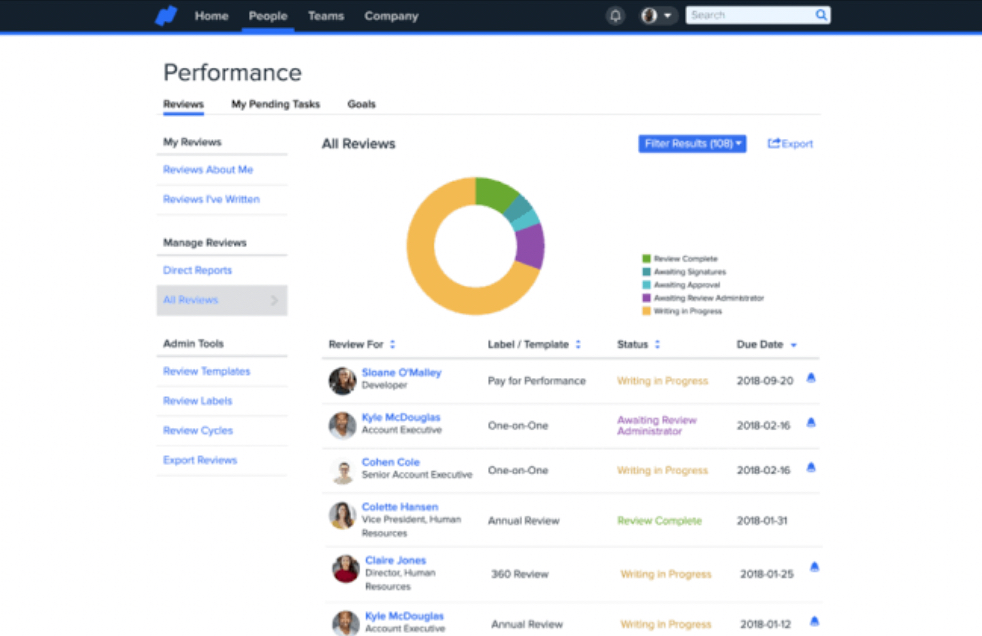

7. Namely

Namely is tailored for mid-sized organizations that need a balance of HR and payroll functionality with customizable features.

Namely provides an integrated platform that manages everything from employee performance to payroll processing, within an easy-to-use, customizable system.

Key Features

- Payroll Processing: Includes tax compliance and automated payments.

- Benefits Administration: Synchealth insurance, 401(k) and additional employee benefits in real-time with payroll.

- Performance Tracking: Monitor employee performance through custom performance reviews and feedback tools, integrating evaluations with payroll adjustments when necessary.

- Compliance: Automatically updates to stay compliant with new labor laws.

Pricing

The pricing of Namely’s payroll software starts at $9 per employee. The exact amount you’ll pay depends on features you’ve selected with your subscription. For an accurate quote book a demo or request a call with the team.

Pros

- Focus on mid-sized business needs

- Customizable features for performance management

- Integration of payroll and HR functions

Cons

- Higher cost compared to smaller business solutions

- Setup and configuration can be complex

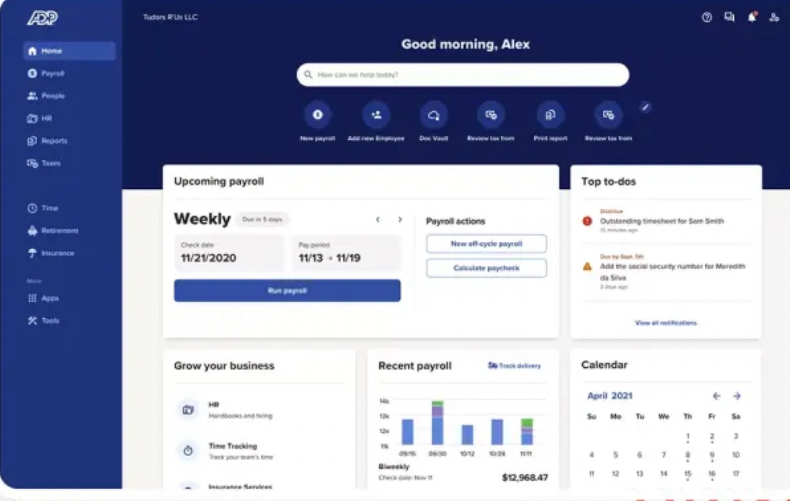

8. ADP

ADP is an established payroll and HR service provider, supplying scalable solutions for large enterprises.

ADP automates payroll processing for businesses with thousands of employees, offering features like global payroll support, advanced compliance tools and custom reporting.

Key Features

- Global Payroll Processing: Multi-country payroll with built-in compliance tools to handle international taxes, currencies and regulations.

- Multi-Location Time and Attendance Tracking: Integrate employee time tracking systems across multiple locations and syncs hours directly into payroll.

- At-Scale Benefits Management: Administer health insurance, retirement plans and wellness programs for thousands of employees.

- Advanced Reporting: Access detailed, custom reports on payroll, benefits and compliance to assess alignment with business goals.

Pricing

ADP’s pricing depends on your exact needs. You can get a custom quote by filling the “get pricing” form on their website or calling the sales team.

Pros

- Ideal for large businesses with complex payroll and HR needs

- Extensive global payroll capabilities

- Advanced tax compliance tools

Cons

- Not suitable for smaller businesses due to complexity

- Higher cost due to enterprise features.

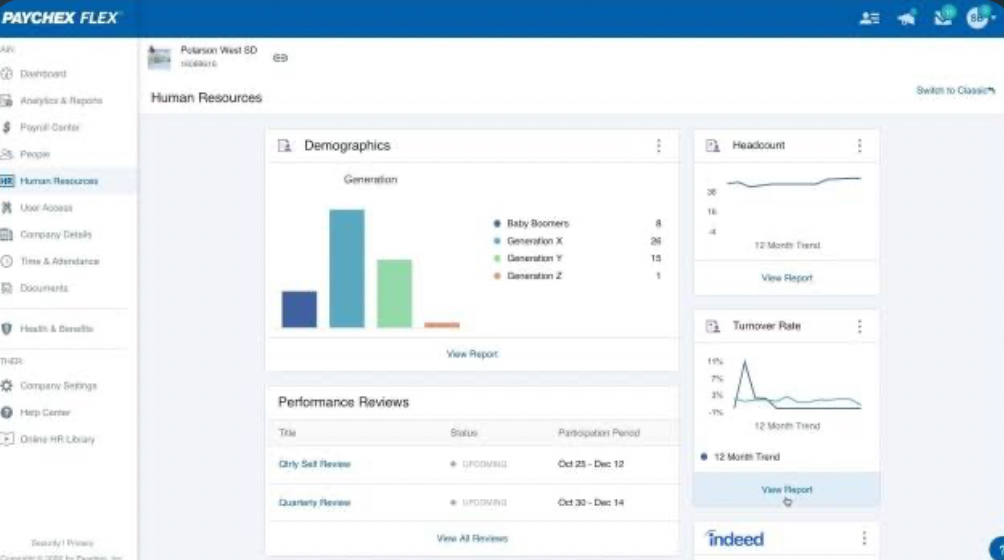

9. Paychex

Paychex provides scalable payroll and HR solutions suitable for small and medium-sized companies.

It combines payroll automation with services like employee benefits management and time tracking with compliance monitoring. Paychex is known for its top-tier customer support and flexible pricing models.

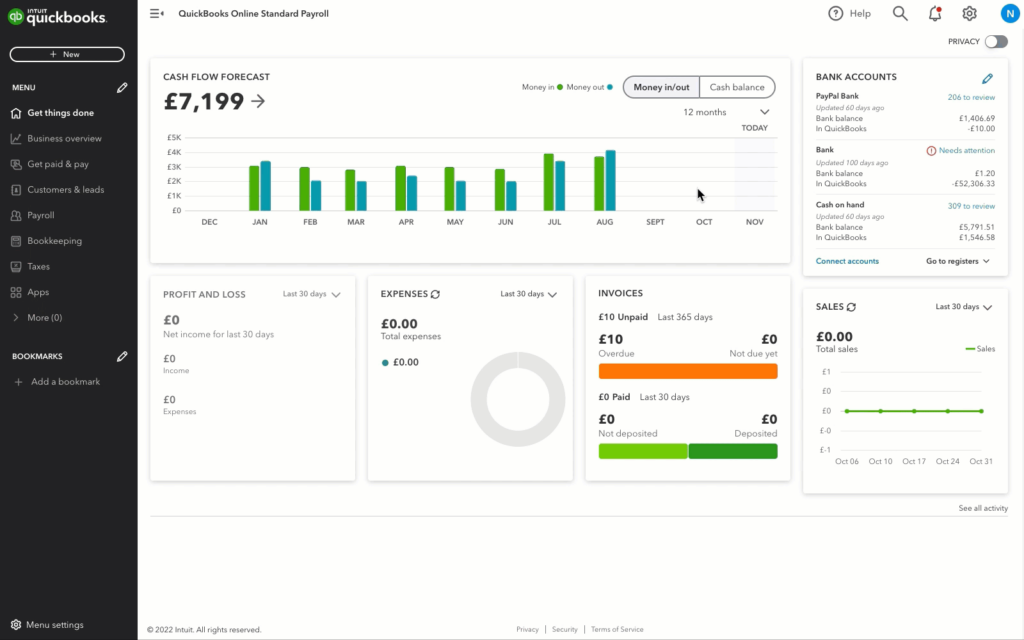

10. QuickBooks Payroll

QuickBooks Payroll is designed to seamlessly integrate with QuickBooks accounting software, providing an easy-to-use payroll solution for small businesses. It automates payroll and tax filing, ensuring efficiency and accuracy.

Key Features

- Year-End Forms: QuickBooks Payroll generates and files necessary year-end forms like W-2s and 1099s. It simplifies the tax process for both employees and employers.

- Employee Self-Service Portal: Employees have access to their pay stubs, tax forms, and personal information through an easy-to-use self-service portal, reducing the HR team’s administrative burden.

- Mobile App: QuickBooks Payroll offers a mobile app that allows employers and employees to manage payroll and view pay-related information on-the-go.

- Benefits Management: Easily manage employee benefits, such as health insurance and 401(k) plans, and automatically sync them with payroll processing to ensure accurate deductions.

Pricing

The pricing plans offer varying levels of payroll, team management, and accounting features, with prices ranging from $42.50 to $114.50 per month, plus additional costs per employee, and increasing complexity in features as you upgrade.

Pros

- Easy integration with QuickBooks, making it ideal for businesses already using their accounting software.

- Automated tax filing ensures compliance with federal, state, and local tax laws.

- Offers direct deposit and timely payroll processing with minimal manual intervention.

Cons

- Fewer customization options compared to enterprise-level platforms

- Lacks some in-depth reporting and analytics options.

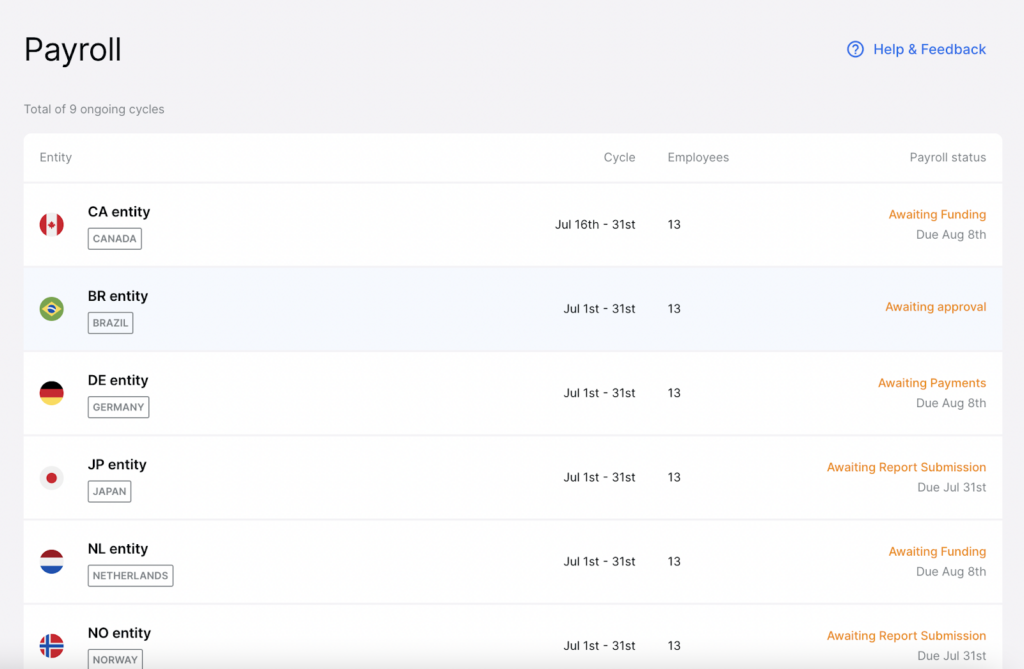

11. Deel

Deel is a modern payroll and compliance platform focused on managing remote teams and international hires. It simplifies payroll, taxes, and compliance for global businesses, ensuring companies can pay employees in any country while maintaining legal compliance.

Key Features

- Global Payroll: Deel handles payroll for employees and contractors worldwide, automatically calculating the correct wages and taxes for each region.

- Compliance Support: Deel ensures compliance with local laws and regulations, helping businesses stay on top of employment contracts and tax requirements in different countries.

- Contractor Payments: Offers easy payments for contractors and freelancers, with the ability to handle multiple currencies and payment methods.

- Team Management: Deel offers collaboration tools to manage global teams, including employee contracts and documents storage, within one platform.

Pricing

Deel offers various pricing plans: Contractor services starting at $49/month, EOR at $599/month, Global Payroll at $29/employee, US Payroll at $19/employee, and US PEO at $89/employee, with tailored compliance, support, and benefits.

Pros

- Ideal for global businesses or those with remote teams.

- Simple integration with accounting and HR tools.

- Comprehensive compliance features for international payroll and employment law.

Cons

- May be overkill for businesses that only need to manage local employees.

- Can become expensive if you have a large remote workforce across multiple countries.

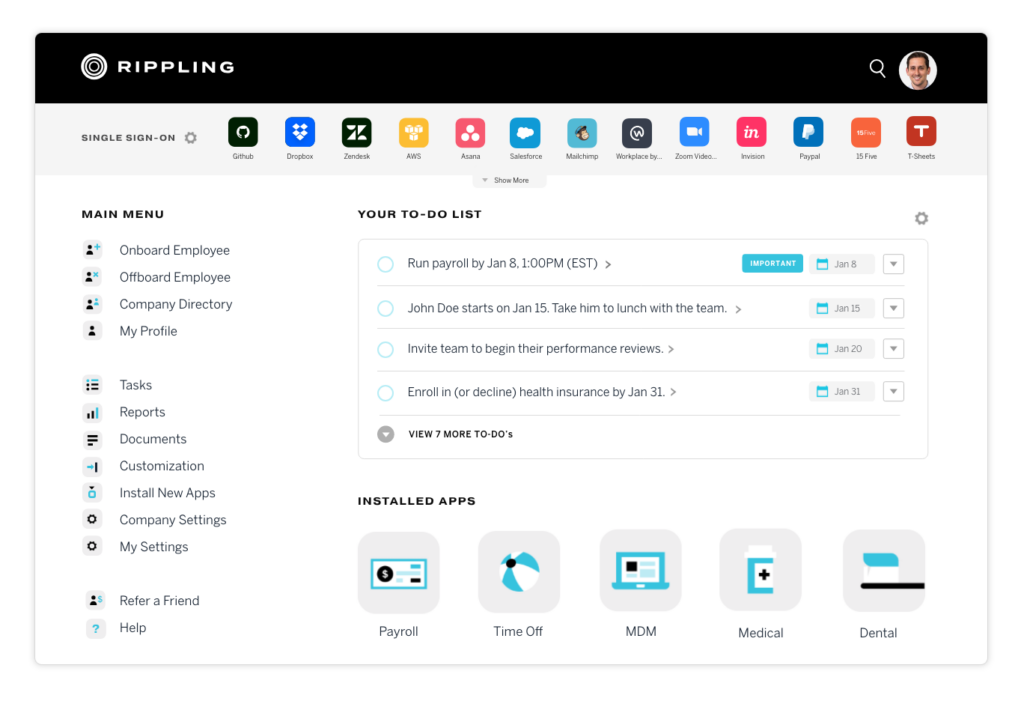

12. Rippling

Ripplin is a cloud-based payroll, and HR platform tailored for small to mid-sized businesses. It provides intuitive payroll management, employee benefits, and HR features to streamline the administrative workload.

Key Features

- Automated Payroll: Ripplin automates payroll processing, calculating wages, taxes, and deductions based on your set preferences.

- Time Tracking: Provides time tracking features to monitor employee work hours and overtime, reducing manual input errors.

- Employee Benefits: Manages a range of employee benefits like health insurance, retirement plans, and more, syncing these automatically with payroll.

- Payroll Insights: Offers detailed payroll reports that give insights into compensation trends, tax deductions, and overall payroll expenses.

Pricing

Contact Ripplin directly for a custom quote tailored to your business needs.

Pros

- Affordable pricing, especially for small businesses.

- Simplifies employee benefits management, saving time and ensuring accuracy.

- Easy-to-use interface with minimal setup time.

Cons

- Limited reporting features compared to more comprehensive HR software.

- Can be less scalable for larger enterprises or those with more complex payroll needs.

Why You Need Automated Payroll Software

- Speeds Up Payroll Management: Payroll automation software tools save time by enabling instant salary calculations, benefits management and payroll approvals. Processing payments can happen in minutes rather than hours.

- Simplifies Tax Filing: Automated software calculates deductions and handles tax compliance, reducing the chance for error and simplifying your payroll during tax season.

- Boosts Employee Engagement and Satisfaction: Pay employees accurately and on time with payroll automation tools.

- Improves Data Security: Payroll automation software often includes advanced security features like encryption and multi-factor authentication. These help to protect sensitive employee information from unauthorized access or data breaches.

- Enhances Scalability for Growing Businesses: As organizations expand, payroll automation software can handle increased complexity and volume without additional manual effort, making it easier to scale operations.

Criteria to Consider When Choosing Payroll Automation Software

- Specialty and Flexibility: Look for software that’s specialized for your industry but flexible enough to support diverse needs. For instance, Checkwriters is favored by non-profits, but its features adapt easily to match various operational needs making it suitable for organizations such as education institutions and private companies.

- Scalability: Choose an automated payroll software that can grow with your organization, whether you have 10 or 10,000 employees

- Mobile Accessibility: Ensure employees and HR staff can access payroll information on the go with a mobile version of the platform.

- Customer-Centricity: Focus on payroll automation platforms with strong customer support, an intuitive user interface and training options to ease adoption.

- Additional HR Features: Go for payroll tools that provide additionalHR features like applicant tracking, onboarding, attendance management and performance monitoring.

Manage Your Employee Payroll with Checkwriters

Checkwriters is a strong choice for payroll automation software – particularly for non-profits, educational institutions, and other medium-sized organizations.

Our focus on human support, flexibility, and integrated payroll and HR management make us a popular choice. With automated payroll processing, compliance support, tax filing features, and an all-around dedication to making the payroll and HR experience stress-free, Checkwriters has become a leading contentender for organizations nationwide.Book a meeting with our team or call (888) 243-2555 to get started today.