Quick Summary

A payroll audit helps you catch pay errors, tax mistakes, and compliance issues before they escalate. This guide covers how to prepare, what to review, and how to fix problems, plus tips to streamline your audit using tools like Checkwriters. For tips and insights that make your HR processes easier, visit the Checkwriters blog.

Payroll Accuracy Starts With a Thorough Audit Process

Payroll errors happen more often than most teams realize. In fact, one in five U.S. payrolls contains mistakes, costing employers an average of $291 each. These small errors often go unnoticed until they lead to bigger issues, like tax problems or compliance risks.

A thorough audit process helps you catch these problems early. But too often, HR and payroll teams only dig into their data when something goes wrong, which should not be so.

In this Checkwriters article, we’ll walk you through how to prepare for and conduct a regular payroll audit from start to finish without overwhelming your team.

Why Listen to Us?

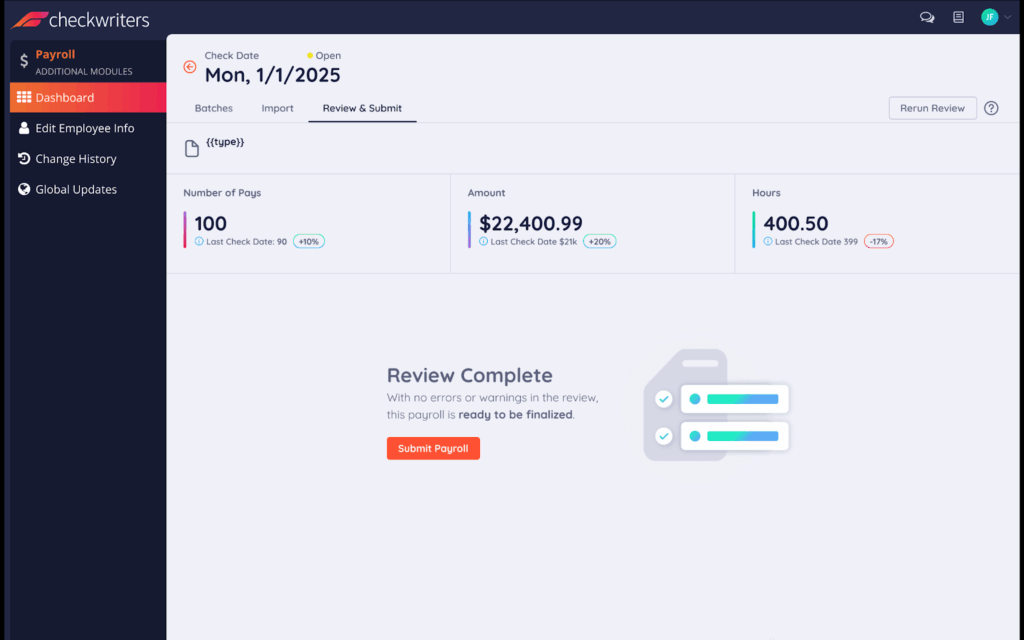

Checkwriters makes payroll audits easier by centralizing payroll, time, and HR data in one platform. You can access time-stamped records, custom reports, and audit logs anytime, so you’re always working from accurate, up-to-date information.

Many HR professionals praise our intuitive platform, responsive support, and streamlined processes.

What Is a Payroll Audit?

A payroll audit is a step-by-step review of your payroll records to ensure wages, taxes, and benefits are accurate and properly documented.

It helps verify employee classifications, tax filings, hours worked, and pay rates, all of which impact compliance, budgeting, and risk exposure. By catching mistakes early, you can fix errors and keep your payroll process running smoothly.

Why Is a Payroll Audit Important?

- Catch Costly Errors Early: Audits reveal issues like overpayments, underpayments, or incorrect tax withholdings before they become legal or financial liabilities.

- Stay Compliant With Laws: Reviewing records ensures you are compliant with current wage laws, overtime rules, and tax regulations.

- Verify Employee Classifications: Misclassifying workers can trigger fines. Audits confirm exempt vs. non-exempt or contractor vs. employee status.

- Build Trust With Staff: Accurate, transparent payroll improves employee confidence and reduces complaints or disputes.

How to Prepare For a Payroll Audit

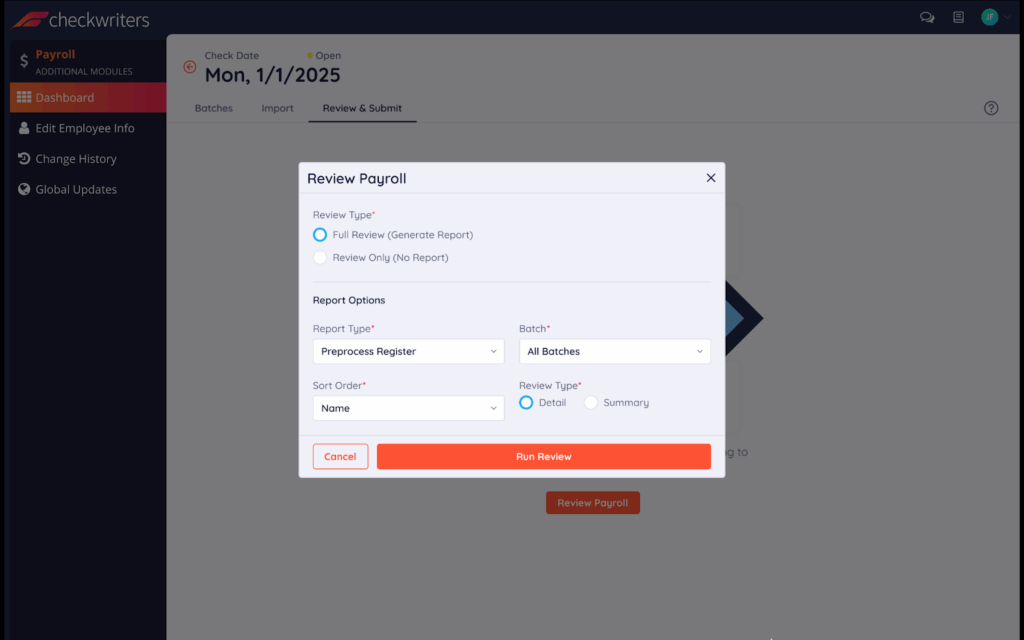

1. Run a Pre-Audit Report to Spot Gaps Early

Before the audit begins, pull a summary of your recent payroll data. This gives you a quick look at everything that’s been processed: wages, hours, taxes, and deductions.

Check for:

- Unusual pay amounts that don’t match the employee’s role or hours worked

- Missing or duplicate entries that could throw off totals

- Tax withholdings or deductions that seem incorrect

- Employees with incomplete or outdated records

To avoid errors, use an HR platform like Checkwriters to generate custom reports within your chosen timeframe, so you know where to focus before digging deeper.

2. Cross-Check Job Titles With Actual Duties

Job titles alone don’t determine how an employee should be classified for payroll. What matters is what they actually do.

Before the audit, take time to review each employee’s role and make sure it matches their job description and classification (like exempt, non-exempt, or contractor).

Look for:

- Outdated job titles that no longer reflect current responsibilities

- Employees doing hourly work but marked as exempt

- Contractors who may be functioning like employees

3. Confirm PTO and Leave Records Match Payroll

Time off should be tracked just as carefully as hours worked. If your PTO, sick leave, or unpaid leave balances don’t match what’s in payroll, it can lead to errors in payment.

Before the audit, compare your time-off records with your payroll system to make sure everything lines up.

Check for:

- PTO balances that haven’t been updated after time off was used

- Employees paid for more hours than they actually worked

- Missing records for approved time off or leaves

With Checkwriters, you can view team time-offs at a glance, helping you know exactly who took leave, when, and whether it was accurately reflected in payroll.

4. Review Who Approves Payroll Changes

Payroll changes like bonuses, pay rate updates, or time adjustments should always go through the right approval channels. Before the audit, check that your approval workflows are current and clearly documented.

Make sure:

- The right people are approving pay changes

- Delegation rules are updated if someone’s role has changed

- There’s a clear record of who approved what and when

5. Store Backup Documents in One Place

During a payroll audit, you may need to show supporting documents like W-4 forms, signed contracts, bonus approvals, or timecard corrections. To make things easier, keep all of these files organized and stored in one secure location.

Make sure you have:

- Signed forms for tax and direct deposit setup

- Documentation for bonuses, deductions, or adjustments

- Records of any policy changes that affect pay

How to Conduct a Payroll Audit

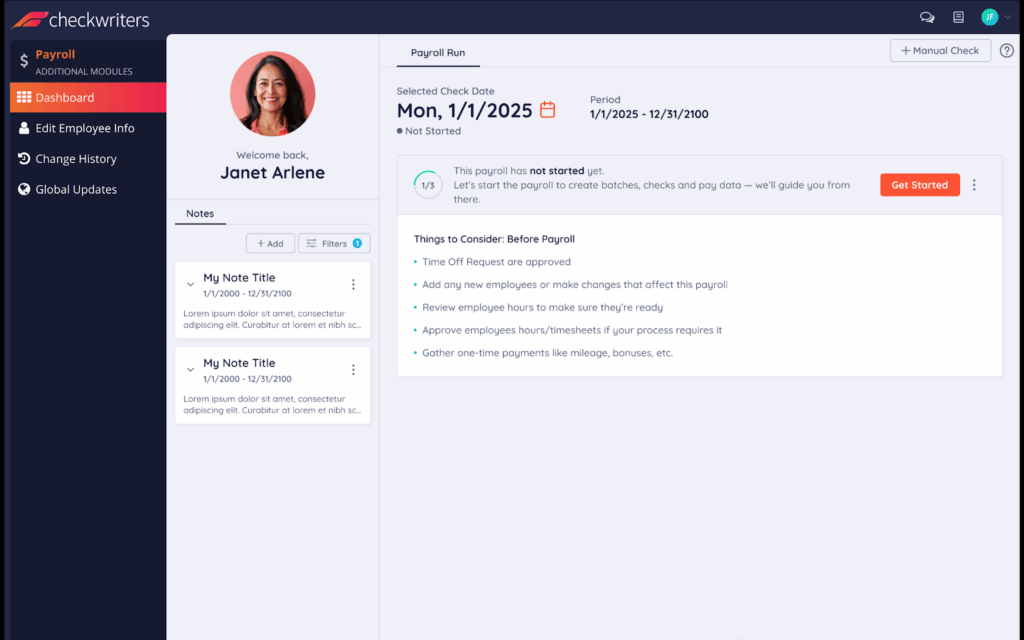

Every payroll audit should begin with a clear timeframe. Most teams audit quarterly, semi-annually, or annually, but you can choose a custom window based on your goals. Afterward, here’s how to conduct your payroll audit.

1. Gather Payroll Records and Documentation

Before you start your audit, gather all the records tied to your selected timeframe. This includes employee timesheets, pay stubs, benefit deductions, and tax payment confirmations. A well-organized documentation makes the rest of the audit faster and more accurate.

Follow these steps:

- Sort records by department or location if applicable. This helps isolate errors that may be limited to specific teams or branches.

- Cross-check payroll reports with actual payments made. Any mismatches should be flagged for deeper review in later steps.

- Organize your files clearly. Use a folder structure or shared drive with naming conventions that make files easy to locate.

- Avoid using outdated or disconnected spreadsheets. Instead, use a system that keeps payroll, time, and benefits data in one place. This helps ensure you’re working with the most current information.

With Checkwriters, you can access accurate, time-stamped records in one place, including payroll history, audit logs, and employee profiles for faster prep. For example, we helped Berwick Academy improve documentation by making payroll and HR records easier to access and organize, strengthening their internal workflows.

2. Confirm Employee Classifications and Status

Classification errors are one of the most common and costly payroll issues. During your audit, review each employee’s classification and make sure it reflects their current job duties and pay structure.

Here’s what to look out for;

- Check exempt vs. non-exempt status. Use the FLSA salary and duties tests to determine if the employee is correctly classified. If they don’t meet both, they may be eligible for overtime, even if they’re salaried.

- Review independent contractors. A 1099 contractor should work independently without direct oversight. If you control their hours, tools, or workflow, they may need to be reclassified as an employee.

- Look for red flags that signal misclassification: These include;

- Contractors working full-time schedules

- Salaried employees who don’t meet the duties test

- Employees who’ve switched roles but not classifications

- Keep supporting documents updated. Make sure you have current job descriptions, signed offer letters, and notes from previous audits to back up classification decisions.

With Checkwriters, you can view employee profiles, job data, and classification history in one place. That makes it easier to update records and stay organized during your audit. However, while tools like Checkwriters help manage the data, it’s up to your team to ensure that classifications are correct and in line with regulations.

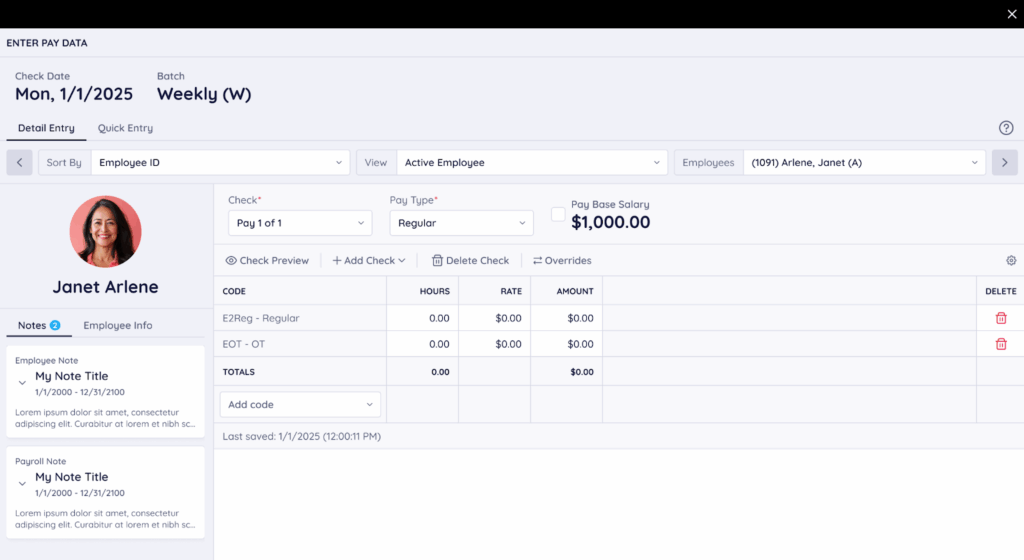

3. Verify Hours Worked, Pay Rates, and Overtime

After confirming classifications, take a close look at how employees were paid for their time. This includes regular hours, overtime, and shift differentials.

Follow these steps for your review:

- Compare time and attendance records to payroll reports. Look for gaps, missed punches, duplicate entries, or manual overrides. These often show up in hourly roles where small errors add up quickly.

- Check for rounding issues. Over time, minor rounding differences can result in underpayment or overpayment.

- Review hourly employee pay against scheduled hours. If someone’s consistently underpaid by just one hour per week, that’s 52 hours lost annually.

- Confirm accurate pay for salaried employees. Look for unapproved deductions or adjustments. If someone took unpaid time off or had a mid-cycle rate change, make sure it’s reflected in their paycheck.

- Use integrated tools for accuracy. With Checkwriters, synced attendance logs and payroll data make it easier to trace each paycheck back to actual hours worked.

Once your review is complete, document any mismatches and resolve them quickly. Fixing small issues now can help prevent larger disputes down the line.

4. Check Tax Withholdings and Deductions

Small tax errors can create major compliance risks. During your audit, make sure tax deductions and other withholdings are accurate and up to date.

Here’s how to run your check effectively;

- Compare each employee’s W-4 to payroll records. Make sure filing status, dependents, and adjustments are reflected correctly.

- Check actual tax amounts against IRS and state tax tables. Confirm that deductions align with the employee’s pay frequency and earnings.

- Verify federal, state, and local withholdings. Look closely at FIT, SIT, and any local income taxes.

- Review FICA and Medicare deductions. Ensure these amounts are applied consistently and correctly.

- Audit other payroll deductions. These include;

- Wage garnishments

- Retirement contributions (e.g., 401(k), 403(b))

- Insurance premiums

- HSA or FSA contributions

- Pre-tax vs. post-tax benefits

- Reconcile deductions with vendor payments. If you’ve withheld $500 for health insurance, your provider should receive $500. Any mismatch could signal a timing or setup issue.

At Checkwriters, we automatically apply the latest tax rates to each payroll run, reducing the chance of using outdated tables, especially during midyear tax changes.

5. Review Benefits, PTO, and Other Adjustments

Benefits and leave-related adjustments often get overlooked during audits. But they directly affect net pay, accrual balances, and compliance with state and federal rules.

During your audit, check the following;

- Benefit deduction amounts match enrollment selections. Premiums should reflect the correct plan and coverage level.

- No expired or unused benefits are still listed as active. Watch for coverage that should have ended or changed but didn’t.

- Rate changes are applied correctly. If benefit costs changed mid-cycle, confirm that payroll reflects those updates.

- Each deduction is properly linked to the employee’s enrollment. With Checkwriters, benefit elections and payroll deductions are synced, so you can trace each deduction back to the source.

Next, audit PTO balances and accruals to ensure they’re accurate and policy-compliant.

Look for:

- PTO accruals match the employee’s time worked and accrual rate.

- Carryover and reset rules follow your internal policy.

- Sick leave is tracked separately, if required by law.

- Any mid-cycle updates, like leave adjustments or resets, are reflected in payroll.

Accurate benefit and PTO records build employee trust and help avoid issues during termination or payout.

6. Document Findings and Resolve Discrepancies

An audit isn’t complete without documentation. Logging your findings ensures there’s a clear trail for future audits, internal reviews, or employee questions.

Start by creating an audit log that tracks every issue you find, even the small ones. Include:

- What triggered the issue

- How and when it was resolved

- The employee name (if applicable)

- The affected payroll period(s)

- A reference number or identifier for tracking

Then, resolve issues in order of impact:

- Underpayments or overpayments that affect take-home pay

- Incorrect deductions or benefit contributions

- Classification errors that change overtime eligibility

- Timing mismatches between worked hours and pay periods

Meet with payroll and HR team members to review your findings. If you see repeat errors, use the opportunity to tighten processes or build in checks to prevent future issues.

Finally, store your audit log in a secure, accessible location, digital or physical. Make note of any follow-up items for the next quarter. A clear audit trail builds accountability and helps you stay ready for external audits or employee inquiries.

Where possible, reconcile your findings with your general ledger to ensure payroll expenses align across systems. HR and finance teams should always be working from the same data.

Best Practices for Payroll Audit

- Audit a Random Sample in Depth Before Scaling: Start with a random sample across roles and locations. If you spot recurring errors, expand the audit to that group for deeper review.

- Use Version-Controlled Documents: Payroll audits involve multiple contributors, making version control important. Use a system that tracks report versions and time-stamped changes.

- Audit After Pay, Benefit, or Tax Changes: Run audits after major events like pay changes, benefit updates, or tax adjustments to catch issues early and fix them before the next payroll cycle.

- Match Payroll With Accounting: Make sure your payroll totals align with your general ledger. This helps catch coding errors, timing issues, or missed entries.

Simplify Your Payroll Audits with Checkwriters

Payroll audits are one of the simplest ways to prevent errors before they impact your team. A clear process makes it easier to catch problems early and improve operations.

Checkwriters makes your payroll audit seamless. Our platform syncs payroll, time tracking, HR data, and reporting, so you can audit from a single, accurate data. With built-in tools like audit logs, custom reports, and version-controlled records, you’ll spend less time tracking down issues and more time fixing them.

Request a demo to get started with Checkwriters today.Disclaimer: The information contained herein is not intended to be construed as legal advice, nor should it be relied on as such. Employers should closely monitor the rules and regulations specific to their jurisdiction(s) and should seek advice from counsel relative to their rights and responsibilities.