Quick Summary

This article explains how payroll analytics can help HR teams improve operations and reduce costs. It covers what to track, how to spot trends, and how to use data to make better decisions. For tips and insights to simplify your HR processes, visit the Checkwriters blog.

Struggling to Spot Inefficiencies in Payroll Data?

Payroll data is one of the most underused tools in operations. Many HR teams process payroll and run reports, but don’t use the data to identify operational issues like rising labor costs or high turnover.

Without a way to track and analyze patterns, small inefficiencies build up over time. This affects budgets, staffing, and overall performance.

In this Checkwriters guide, we’ll walk you through effective ways to use payroll analytics to improve business operations.

Why Listen to Us?

Checkwriters helps HR teams turn payroll data into smarter business decisions. Our platform connects payroll, time tracking, and reporting in one place, making it easier to spot trends, reduce errors, and act quickly.

MicroGenDX, for example, scaled from a few dozen to a few hundred employees in multiple states using our HR and payroll solution to stay organized and compliant.

What Are Payroll Analytics?

Payroll analytics is the process of tracking, measuring, and interpreting payroll data. This helps to spot patterns, fix problems early, and make better decisions about your workforce.

Instead of just running payroll and moving on, HR teams use analytics to understand what’s really happening behind the numbers. For example, you can track labor costs over time or see how headcount changes are affecting your budget.

With the right tools, you can build custom reports that highlight what matters without relying on manual processes.

Why Are Payroll Analytics Important?

- Uncovers hidden costs: Helps you see where overtime, bonuses, or staffing gaps are driving up costs, so you can fix them early.

- Improves compliance tracking: Tracks changes in rules and gives you reports that help support compliance.

- Supports better planning: Lets you align payroll data with hiring plans, seasonal trends, and budget goals.

- Reduces errors: Makes it easy to spot mistakes like overpayments or missing hours before they affect paychecks or budgets.

- Drives operational efficiency: Saves time by automating reports and making audits simpler.

How to Use Payroll Analytics to Improve Operations

1. Identify Key Payroll Metrics

Payroll data is only useful when it helps you solve a real problem. That’s why every metric you track should start with a clear goal.

To identify your goal, ask questions like:

- Are we trying to lower costs?

- Is turnover becoming a problem?

- Are productivity levels decreasing?

Once you know what you’re solving for, focus on metrics that help you take action. Not all payroll data is useful on its own, but some metrics can tell you a lot about how your team and budget are doing.

Next, here are some key metrics you could start with:

- Labor costs: Shows you where most of your budget goes

- Employee count: Tracks team size to spot gaps, growth, or staffing issues.

- Payroll errors: Highlights mistakes that affect pay and slow down admin work.

- Time-to-Payroll completion: Shows how long payroll takes. Longer times may mean inefficiencies.

- Employee turnover rate: Reveals how much staff departures are costing your business.

For example, a midsize hospitality group notices weekend overtime costs rising. After analyzing payroll data, they find that the issue is short-staffing during peak hours. That insight leads to better scheduling where it’s most needed.

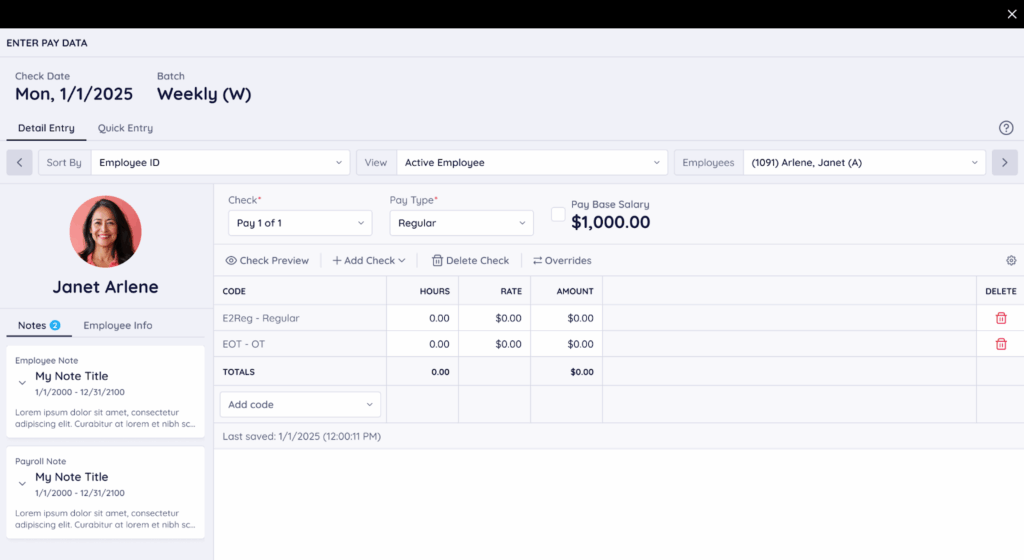

2. Collect Accurate Payroll Data Regularly

If your data inputs are inaccurate, your reports will be too. Data inaccuracies often start with mismatched systems, manual overrides, or unclear pay codes. This is common in industries with shift-based structures, seasonal roles, or multiple locations.

For example, the hospitality group from earlier also has rotating managers at each location. One manager logs PTO as unpaid leave. Another logs it as a bonus. Both affect payroll differently and show up as errors in reports.

Instead of chasing down errors after payroll runs, build quality checks into the process from the start.

Here’s how to do so effectively:

- Set clear processes: Ensure everyone reports and approves time the same way.

- Run regular checks: Audit your data regularly to catch mistakes early before payroll runs.

- Set digital approvals: Make sure managers approve hours and exceptions before payroll.

- Limit manual overrides: Avoid last-minute changes and clearly document any exceptions.

- Use integrated tools: Your payroll software should sync time tracking, scheduling, and payroll to reduce errors.

Checkwriters’ payroll tools connect time, payroll, and benefits data in one system to reduce the risk of inconsistencies and collect real-time, accurate data.

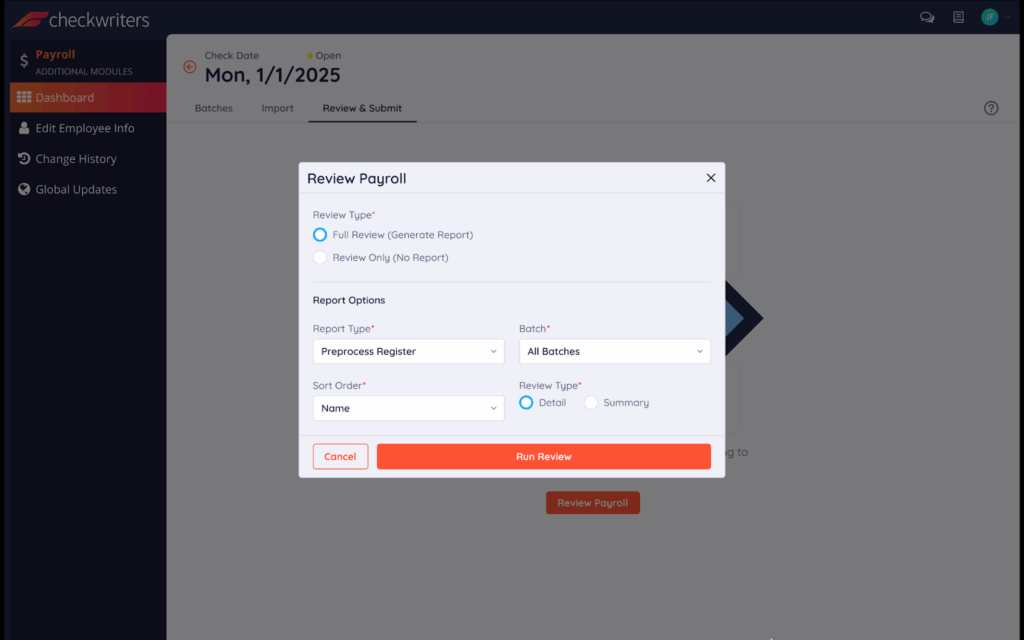

3. Use Reporting Tools to Generate Payroll Reports

Payroll data isn’t just for processing paychecks; it’s full of insights that can help you make better decisions. But those insights only matter if you can see them clearly.

That’s where reporting tools come in. Instead of digging through spreadsheets, you can create custom reports on any data point (location, department, pay type, or job role) that answers real business questions.

Want to know why labor costs spiked last month? Or which departments are logging the most overtime? A good payroll report shows you what’s happening and what’s causing it.

Here are a few examples of payroll reports you can create:

- Payroll cost vs. Budget by department: See if spending is in line with what you planned.

- Overtime variance over time: Track spikes or dips in overtime across weeks or months.

- PTO usage trends across roles: Know which teams are using time off consistently or not at all.

- Pay distribution across salary bands: Make sure compensation is balanced and fair across roles.

- Missed clock-in patterns by shift or location: Catch attendance issues that could affect payroll accuracy.

Automation makes this even easier. Instead of pulling data manually, you can schedule reports to your inbox before every planning meeting, saving you lots of time.

In Checkwriters, you can filter, export, and create automated reports that match how your business runs, so the data is ready to use the moment you see it.

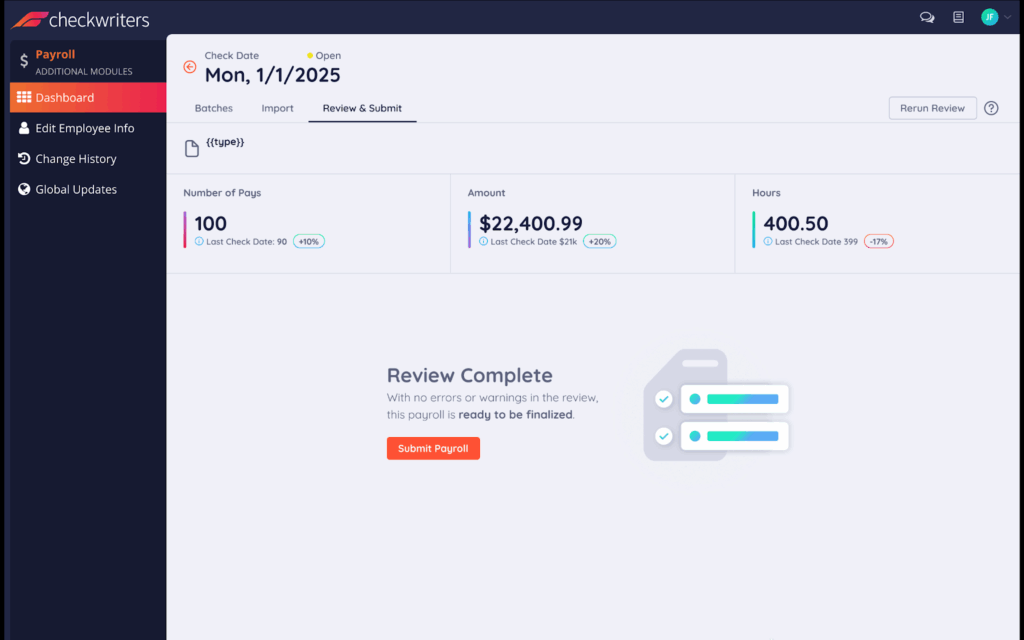

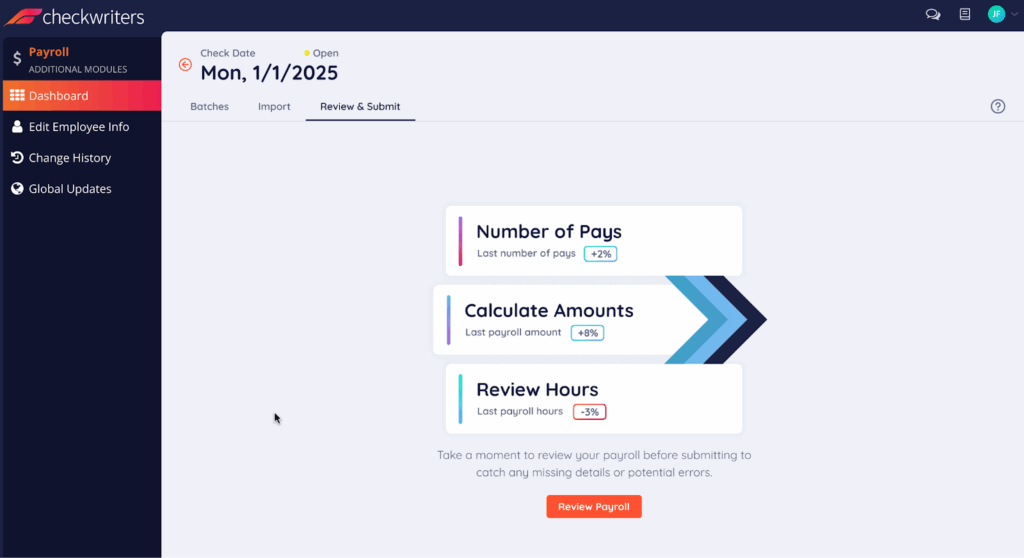

4. Analyze Trends to Uncover Patterns

Looking at a single payroll report is like taking a snapshot; you don’t get the entire view. But analyzing your data over time helps you see the full picture, and that’s where the real value lies.

For example, if overtime costs are slowly increasing every month, that might point to a staffing shortage or scheduling issue. These issues don’t always show up right away, but trend analysis helps you catch them before they grow into bigger problems.

Trends can also reveal gaps in your internal processes. Maybe certain managers consistently approve hours late, delaying payroll. Or maybe turnover spikes every spring, hinting at onboarding gaps. The goal is to spot patterns early, know what’s causing them, and take action before the impact spreads.

Here’s what to look for when analyzing data:

- Rising overtime: Could indicate overworked teams or poor shift planning.

- Inconsistent clock-in/out behavior: Might signal missed breaks or buddy punching.

- Department-level payroll variances: May reveal budget misalignment or incorrect job coding.

- Recurring payroll errors: Suggest weak spots in your approval or data entry process.

In Checkwriters, you can filter payroll data by date, department, or headcount, making it easier to track trends, surface red flags, and build custom insightful reports.

5. Share Insights With Stakeholders to Guide Decisions

The insights you uncover from your payroll data shouldn’t stay in reports. They should help department heads, finance teams, and leadership make smarter decisions.

For example, an HR Director at a mid-size nonprofit sees rising turnover in entry-level roles and a pattern of high early PTO use and slow onboarding. By connecting the trends, she can make a strong case for leadership to invest in better training resources.

But to make this work, your data needs to be easy to understand. Long spreadsheets won’t cut it. Use clear visuals, simple summaries, and straightforward reports that answer real questions like “Why are costs rising in one department?” or “Where can we reduce manual work?”

Here’s how to make insights easier to share:

- Customize reports by audience: Finance may need cost breakdowns, while managers may need scheduling trends.

- Keep it visual: Use charts, graphs, and comparisons to highlight key takeaways quickly.

- Automate delivery: Schedule reports to send before meetings, so everyone’s aligned ahead of time.

6. Apply Findings to Operations

Once you’ve spotted trends in your payroll data, the next step is to use those insights to improve how your business operates.

Let’s say your reports show rising overtime in one department. The fix might be hiring more staff, adjusting shift schedules, or reworking task assignments. If your data reveals frequent payroll errors tied to late time approvals, the solution could be setting stricter approval deadlines or adding automated reminders.

Data should help you answer questions like:

- Do we need to rebalance workloads across teams?

- Should we adjust staffing levels for certain periods of time?

- Are there bottlenecks in our approval or scheduling processes?

- Can we reduce admin time by automating more tasks?

Small adjustments like realigning PTO policies or refining employee onboarding workflows can lead to measurable results when guided by solid payroll data.

7. Track Progress Over Time

After making changes based on your payroll insights, use the same data to monitor whether those changes are working.

Let’s say you adjusted shift schedules to reduce overtime. Use your payroll reports to compare current overtime levels to previous months. If you improved your onboarding process to address turnover, monitor payroll activity for new hires to see if retention improves.

Tracking these outcomes helps you stay accountable. It also gives you a chance to refine your approach if something isn’t working as expected.

On Checkwriters, you can schedule recurring reports and filter data by a period of time, department, or employee type, making it easy to measure what’s changed and what still needs attention.

Best Practices for Using Payroll Analytics

- Segment reports by workforce type: Break down data by full-time, part-time, seasonal, or contract roles to get clearer insights. This helps you identify cost drivers and optimize scheduling for each group.

- Align payroll data with business KPIs: Connect labor costs, overtime, and turnover to your broader goals like budget targets or staffing efficiency. This way, payroll numbers become tools for improving business performance.

- Track impact of past changes: Review data after making policy or staffing changes to see what worked and what didn’t. This allows you to build a case for future decisions using real performance trends.

- Use rolling averages instead of snapshots: Look at trends within multiple periods of time to smooth out one-time spikes or dips. It helps reveal patterns and avoids misleading conclusions based on anomalies.

- Audit for payroll anomalies regularly: Look for duplicate payments, missed deductions, or inconsistent pay rates. Regular audits help prevent errors and maintain trust with employees.

- Set thresholds and alerts for key metrics: Set up alerts using tools like Checkwriters to flag unusual changes like sudden overtime jumps before they become bigger issues.

Turn Payroll Analytics Into Actionable Insights With Checkwriters

Payroll data holds the answers to many of your operational challenges, whether it’s managing rising costs, improving staffing, or reducing manual tasks. The key is knowing how to turn those numbers into clear, actionable insights.

Checkwriters makes that easier. With built-in reporting tools, time and attendance tracking, and performance data all in one platform, you can spot trends quickly and share the right information with the right people for better decision-making.

Request a demo today to see how Checkwriters can support your team!

Disclaimer: The information contained herein is not intended to be construed as legal advice, nor should it be relied on as such. Employers should closely monitor the rules and regulations specific to their jurisdiction(s) and should seek advice from counsel relative to their rights and responsibilities.