Quick Summary

Nonprofit payroll follows the same rules as for-profit payroll but with higher stakes due to tight budgets, donor accountability, and strict compliance. This guide covers setup, compliance essentials, common pitfalls, and best practices. It also shows how a provider like Checkwriters can simplify the process so you can stay focused on your mission.

Ready to Pay Staff Without Risking Compliance?

If you’ve just reached the point where your nonprofit needs to pay staff, you’re also at the point where compliance and credibility start to go hand in hand.

Payroll for nonprofits isn’t wildly different from payroll for a for-profit business—you still have to classify workers, withhold taxes, and file the right forms. The difference is that nonprofits often operate with tighter budgets and greater accountability, so mistakes carry more weight. An error in classification or a missed filing could create compliance issues with the IRS, and that’s stress no nonprofit needs.

This guide will make the process clear and manageable. Whether you’re a small nonprofit paying your first employee or a growing organization refining your systems, consider this your straightforward roadmap to handling nonprofit payroll the right way.

Why Listen to Us?

Payroll is what we do every day at Checkwriters. We’ve spent years helping nonprofits of all sizes manage payroll, HR, and compliance with less stress and more confidence.

The bottom line? You can trust this guide comes from real experience with nonprofits like yours. If you want payroll explained clearly, with practical steps you can use, you’re in the right place.

How Is Payroll Different for Nonprofits?

At first glance, payroll might seem straightforward: classify workers, withhold taxes, and file the right forms. But when you apply those rules in a nonprofit setting, the context makes everything more complex.

Nonprofits typically run on tighter budgets, often with a mix of staff, contractors, and volunteers. That alone can create confusion about who should be paid, how they should be classified, and which funds can legally cover their wages.

Then there are the donors and grantmakers who expect accountability for every dollar spent. That means you must be able to document payroll expenses clearly and show that restricted funds are being used appropriately. Payroll errors in this context don’t just risk fines—they can undermine donor confidence, threaten grant renewals, and damage your organization’s credibility.

The point is that while the payroll rules are the same, the stakes are higher.

Nonprofit payroll can look simple, but the details are often tricky. Knowing the fundamentals helps you stay compliant, protect credibility, and avoid stress later.

Here’s what you need to know:

Worker Classification

This is where many nonprofits get confused. It’s also the area where you need to be most careful.

When it comes to nonprofits, workers are either classified as employees (W-2) or independent contractors (1099).

If they’re employees, you’re responsible for withholding taxes, paying into Social Security, Medicare, and unemployment, and providing benefits if you offer them.

But if they’re contractors, it’s different. They invoice you, handle their own taxes, and decide how and when the work gets done.

Mixing this up can be costly. Treating employees as contractors can lead to penalties, back taxes, or even lawsuits, while treating contractors as employees can increase your costs unnecessarily.

The safest approach? If someone works like a staff member, treat them as an employee. If they operate on their own terms and outside your control, treat them as contractors.

Payroll Taxes and Withholdings

Nonprofits may be tax-exempt when it comes to revenue, but payroll taxes are never optional.

Like any employer, you must withhold and remit:

- Federal income tax (based on W-4 forms)

- Social Security and Medicare (FICA)

- Federal and state unemployment taxes (FUTA/SUTA)

Some states and localities also impose additional payroll taxes, such as paid leave programs or disability insurance. Missing these obligations can quickly create compliance headaches.

Required Forms

The paperwork can feel endless, but each form plays a key role:

- W-4: Completed by employees so you know how much federal income tax to withhold

- W-2: Issued annually to employees, showing total wages and taxes withheld

- 1099-NEC: For contractors you’ve paid $600 or more in a year

- I-9: Verifies employment eligibility for every employee

- State registration forms: To set up tax accounts and pay state unemployment contributions

Think of these as your payroll “starter pack”—you can’t run payroll correctly without them.

State and Local Labor Laws

Payroll isn’t limited to federal requirements; you also need to comply with state and sometimes local laws. Depending on your location, that could mean:

- Minimum wage laws above the federal rate

- Mandatory paid sick leave or family leave

- Local payroll taxes imposed by certain cities or counties

Always check both state and local regulations. What’s compliant in one state could result in penalties in another.

How to Set Up Payroll in a Nonprofit

Now that you understand the basics, let’s break payroll setup down into clear steps.

Step 1: Register as an Employer

Before you can run payroll, your nonprofit needs to be recognized as an employer. That starts with getting an Employer Identification Number (EIN) from the IRS. You can apply online through the IRS website, fax or mail Form SS-4, or work with your accountant to apply on your behalf.

After that, you’ll need to register with your state labor and tax agencies so you can pay into unemployment systems and handle state income taxes.

Step 2: Classify Your Workers

Classification is where many nonprofits slip up. You must decide whether each person is an employee (W-2) or an independent contractor (1099).

Employees are under your control—your schedule, your tools, and your direction—and require tax withholdings, unemployment coverage, and benefits.

Contractors, on the other hand, run their own show: they invoice you, pay their own taxes, and decide how the work gets done.

Step 3: Collect Employee Forms

For each employee, you need a W-4 for federal tax withholdings and an I-9 to confirm their eligibility to work in the U.S. Most states also require their own withholding forms.

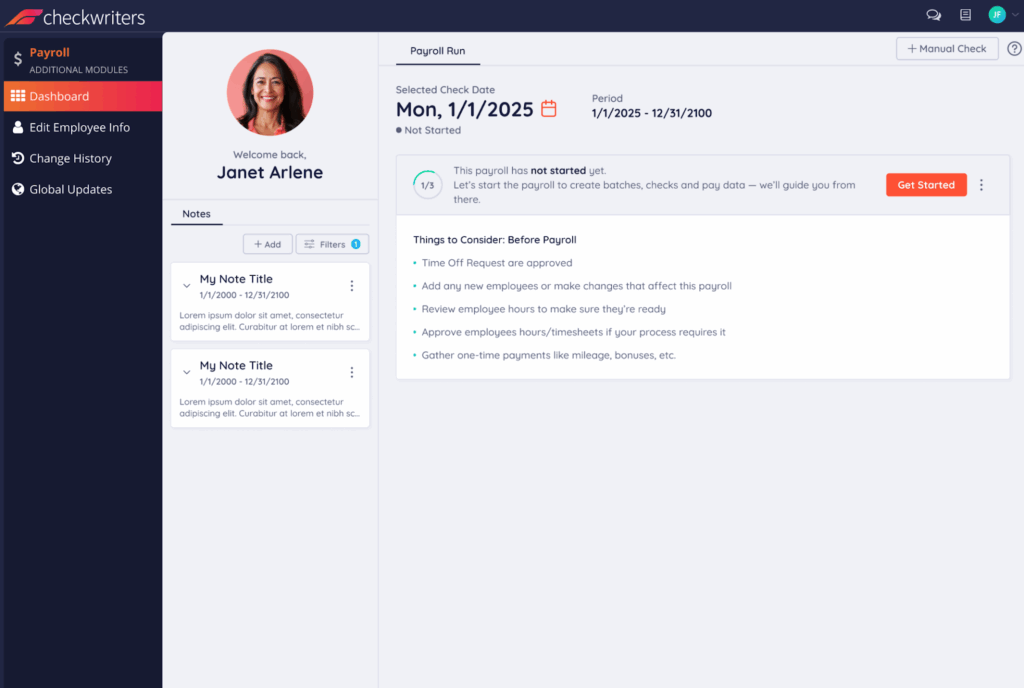

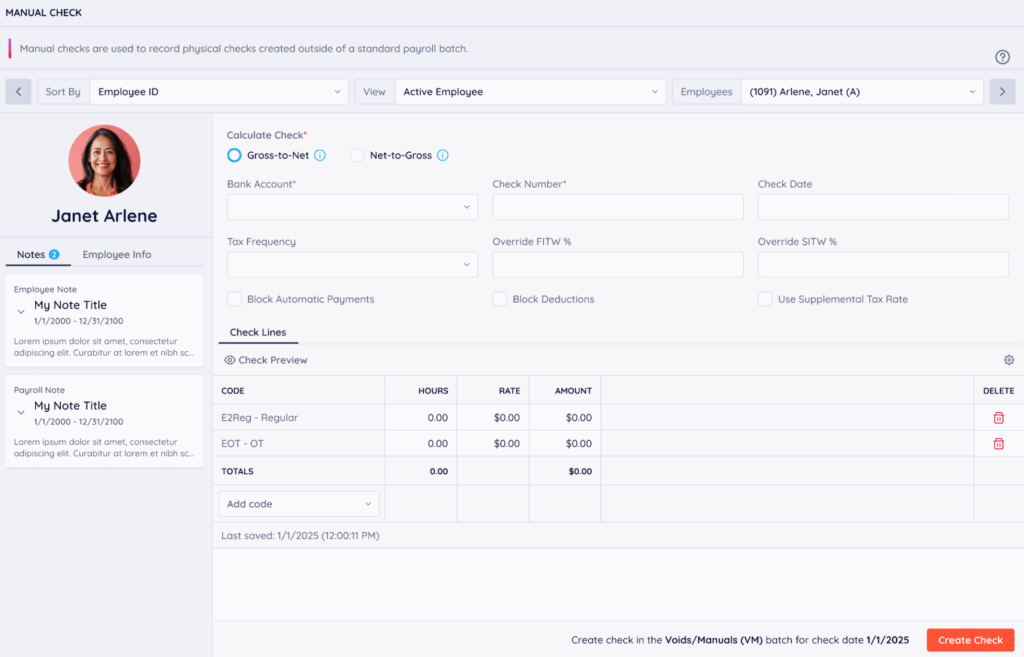

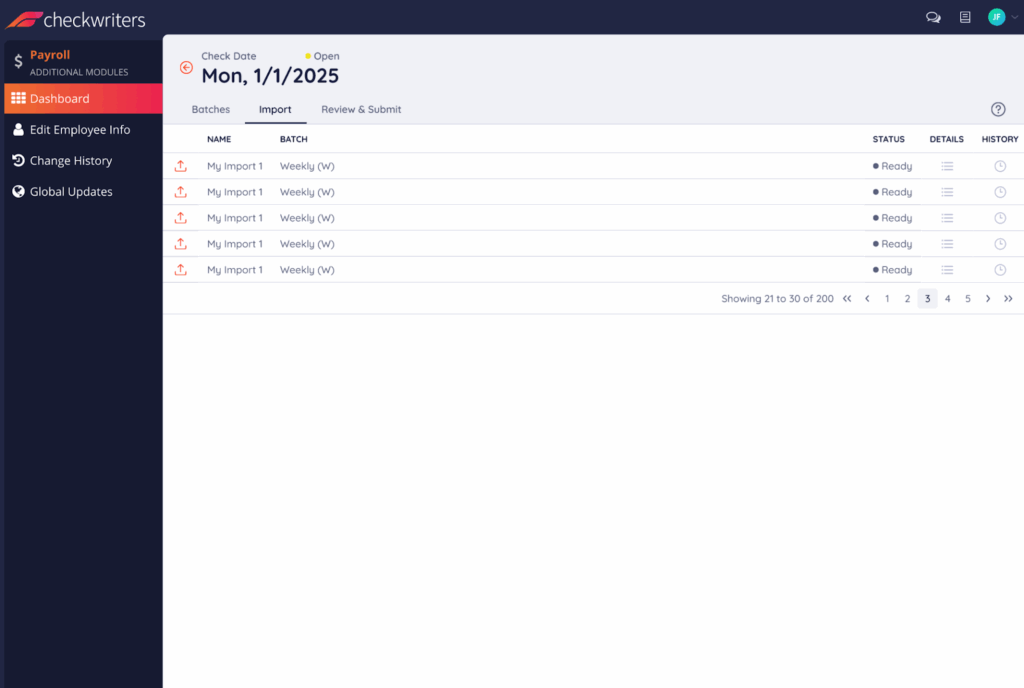

Forgetting these forms can lead to errors in withholdings or even compliance violations. Checkwriters makes this easier by letting employees fill out and store all required forms digitally in a secure self-service portal.

Step 4: Choose a Pay Schedule

Decide how often you’ll pay your staff—weekly, bi-weekly, or monthly. Many states have laws about minimum pay frequencies, and once you publish a schedule, you’re expected to stick to it. Employees also value consistency.

Step 5: Calculate Wages and Withholdings

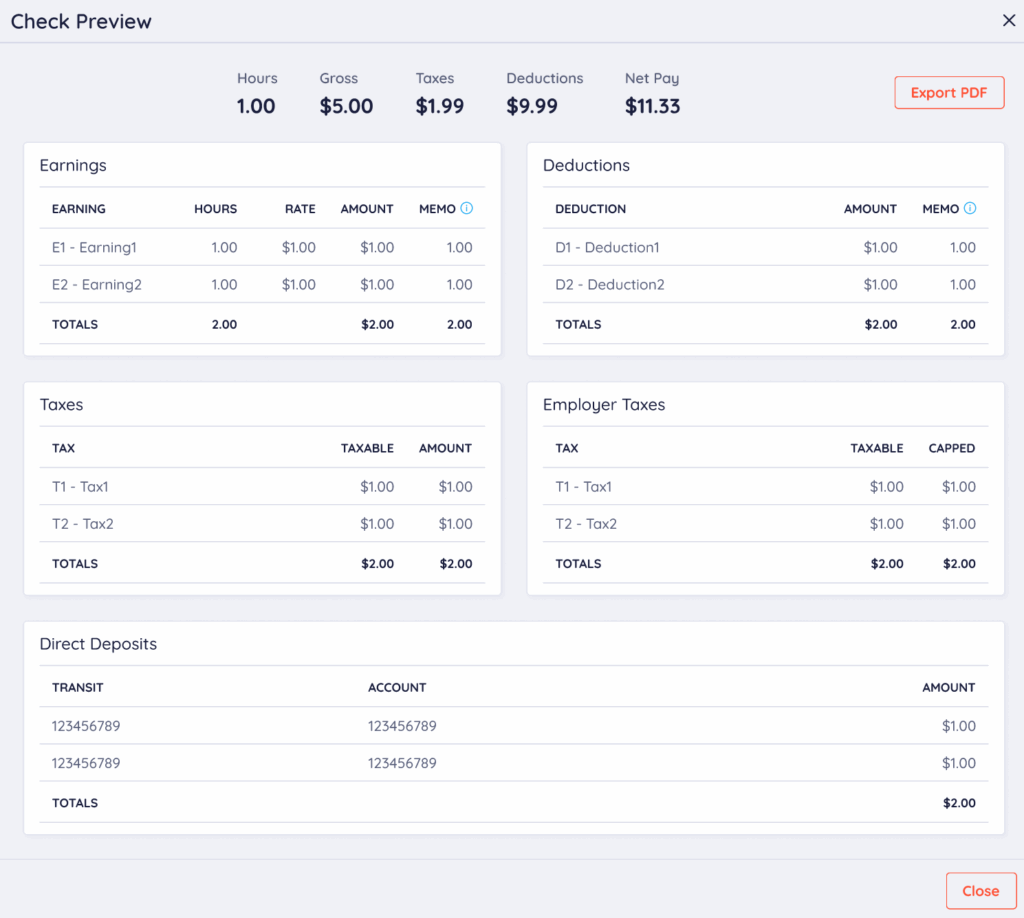

Here’s where the math comes in. You need to total up hours (for hourly staff), calculate gross pay, and then subtract the right withholdings: federal and state taxes, Social Security, Medicare, unemployment, plus any benefits or deductions like retirement.

It can be a lot to keep track of, which is why most employers rely on payroll systems to handle this step. With Checkwriters, all of these calculations happen automatically, so gross pay, deductions, and net pay are always accurate and easy to review.

Step 6: Remit Taxes and Contributions

Collecting taxes from your employees is only half the job—you also need to send those taxes, along with your share of Social Security, Medicare, and unemployment contributions, to the proper agencies.

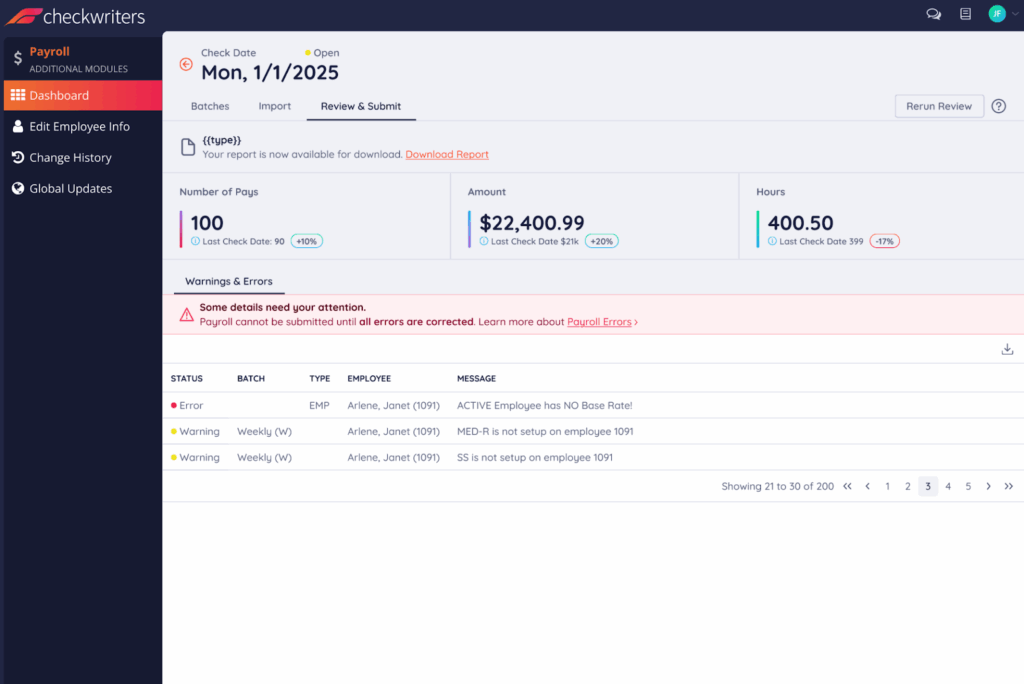

Checkwriters takes care of this step automatically. Payroll taxes are filed and paid on schedule, and all employer contributions are included.

Step 7: File the Required Reports

Every quarter, you’ll need to file Form 941 to report wages and withholdings. At the end of the year, you issue W-2s to employees, 1099s to contractors, and a W-3 summary to the IRS. Many states also require their own payroll reports.

Checkwriters automatically generates and files these reports for you. W-2s and 1099s are delivered on time, employees can access their forms online, and you stay compliant without the paperwork hassle.

If there are any issues or errors, we catch them so you can stay compliant and keep accurate records.

Payroll Options for Nonprofits: Which One Is Best for You?

There’s more than one way to run payroll, but not all options make sense for nonprofits. The right choice depends on your size, budget, and how much time you want to spend managing compliance.

1. Do-It-Yourself Payroll

Some very small nonprofits start by handling payroll manually using spreadsheets, calculators, and IRS forms. While this might work when you only have one or two employees, it’s risky. A single mistake with taxes or worker classification can cost far more than you’d save by skipping professional tools.

2. Payroll Software

Cloud-based software like QuickBooks Payroll, Gusto, or Checkwriters is often the next step up. These systems automate calculations, tax withholdings, and some filings. They’re affordable, but you’re still responsible for making sure everything is set up correctly. For leaders who already wear too many hats, that can still feel overwhelming.

3. Full-Service Payroll Providers

For nonprofits that want peace of mind, outsourcing payroll to a provider is usually the best option. That’s where Checkwriters comes in. Unlike generic software, Checkwriters is a full-service payroll and HR solution designed to keep organizations compliant and efficient.

With Checkwriters, you don’t have to worry about:

- Missing IRS or state filing deadlines

- Misclassifying workers and facing penalties

- Keeping up with changing labor laws

Checkwriters handles the heavy lifting—from tax filings and employee self-service to time tracking and benefits integration—while giving you clear reporting that satisfies boards, auditors, and grant funders.

What Mistakes Do Nonprofits Commonly Make With Payroll?

Payroll mistakes are costly for any organization, but for nonprofits, they can also damage donor trust and put funding at risk. Here are the most common pitfalls and how to avoid them.

Misclassifying Workers

Treating employees like independent contractors may save effort in the short term, but it can lead to IRS penalties, lawsuits, and back taxes. If someone works under your direction and schedule, they’re almost always an employee.

Missing Tax Deadlines

Late or incomplete tax filings can trigger fines, audits, and unnecessary stress. Nonprofits don’t get a free pass; payroll taxes are always required.

Ignoring State and Local Rules

Federal rules are just the start. Many states and even some cities have their own requirements for minimum wage, PTO, or local payroll taxes. Missing them can quickly add up.

Paying “Under the Table”

Some small nonprofits start by writing checks or using cash to pay staff. This may seem simple, but it creates tax problems, audit risks, and can threaten your nonprofit status.

Poor Recordkeeping

Without clear payroll records, audits, and grant reporting become nightmares. Donors and funders expect proof that funds are being used responsibly.

Best Practices to Keep Nonprofit Payroll Smooth and Compliant

Once your payroll is up and running, the real challenge is keeping it consistent and error-free. These best practices help nonprofits avoid surprises and build a reliable payroll system.

1. Stick to a Consistent Pay Schedule

Staff rely on predictability, and labor laws often require you to follow the schedule you publish. Pick a frequency—weekly, bi-weekly, or monthly and stick to it. With Checkwriters, your pay schedule is tracked automatically, so every run is on time.

2. Align Payroll With Grant Budgets

Many nonprofits pay staff from restricted funds. Failing to track payroll against grants can create compliance issues with funders. Checkwriter’s detailed reporting makes it easy to allocate wages correctly and satisfy grant reporting requirements.

3. Automate Tax Filings

Manual filing is risky when deadlines come fast and rules change. Automating ensures you never miss a payment or report.

4. Use Time-Tracking for Hourly Staff

Accurate hours prevent disputes, protect you from wage claims, and simplify overtime calculations.

5. Keep Thorough Records

Payroll records should be retained for at least 3–4 years. Sometimes longer, depending on your state. Good recordkeeping builds confidence with auditors, boards, and donors. Checkwriters makes every pay stub, tax filing, and form accessible on demand.

6. Stay Current on Laws

Payroll rules evolve. Minimum wage changes, new leave laws, or updates in tax rates. Staying informed prevents accidental noncompliance.

Conclusion

Payroll may not be the most exciting part of running a nonprofit, but it’s one of the most important. Getting it right keeps you compliant, builds trust with your team and donors, and protects the mission you’ve worked so hard to grow.

The good news is you don’t have to do it all yourself. With a partner like Checkwriters, payroll becomes simpler, more accurate, and far less stressful. Get started with Checkwriters today.