Quick Summary

Nonprofits need payroll that fits their reality: compliance, grants, tight budgets, and staff who wear many hats. This guide shows you what to look for in a provider, the steps to choose wisely, and why many nonprofits ultimately land with Checkwriters.

Still Wondering Which Nonprofit Payroll Provider Will Work for You?

You’ve probably read plenty of recommendations by now. Some articles will tell you Gusto is perfect for nonprofits. Others insist ADP is the industry standard. Meanwhile, our nonprofit clients tell us that Checkwriters finally solved their payroll challenges.

But after all that research, you’re still asking the same question…

Which payroll solution is actually right for our organization?

The reality is that no single solution works for every nonprofit. What streamlines operations for one organization can create headaches for another. Rather than declaring “the best tool,” this guide will show you how to evaluate providers based on your nonprofit’s specific needs and make a confident decision.

Why Listen to Us

We’ve helped hundreds of nonprofits move from payroll headaches to payroll confidence. Some came to us after DIY tools left them with compliance issues. Others left expensive systems they barely used. See a review from one of our clients.

That’s why our advice isn’t theory. It comes from real experience with nonprofits like yours.

What to Look For in a Nonprofit Payroll Provider

Most payroll providers make the same promises, but what matters is how well the system fits your nonprofit: your staff, your funding, and your compliance needs.

Here are the areas to focus on:

Does it handle filings and nonprofit exemptions automatically?

Nonprofit payroll has unique compliance requirements. Unlike for-profits, you may have exemptions or special filings that can’t be overlooked.

Missing one deadline can create penalties you can’t afford. That’s why you need a payroll provider with tools and notifications that help you stay on top of filings and nonprofit-specific rules. Checkwriters provides features that support audit readiness and keep employers aware of key deadlines.

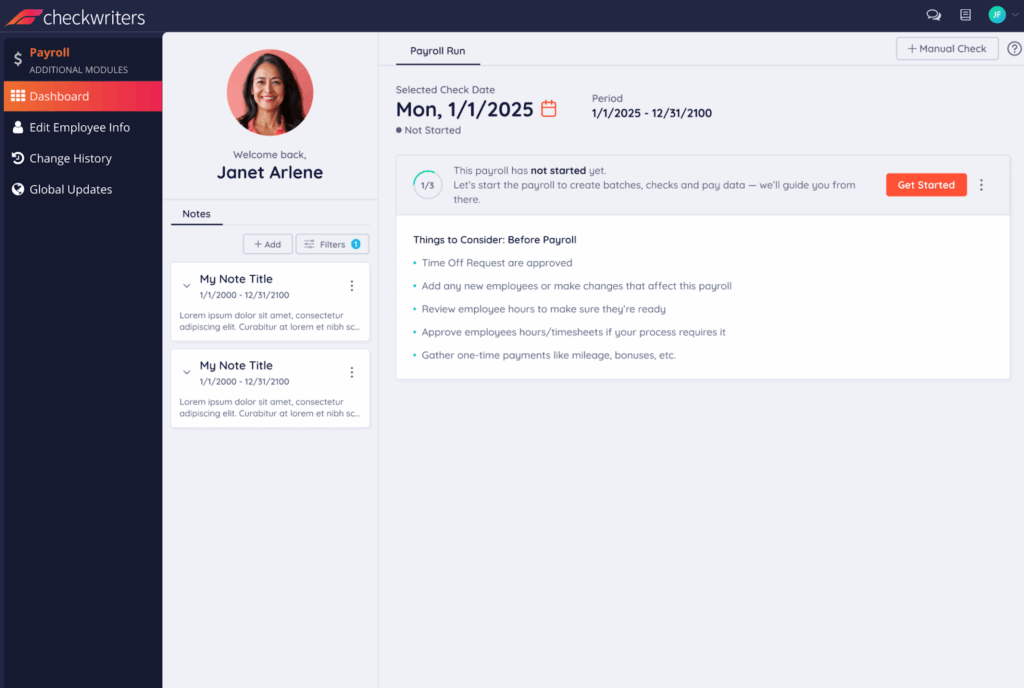

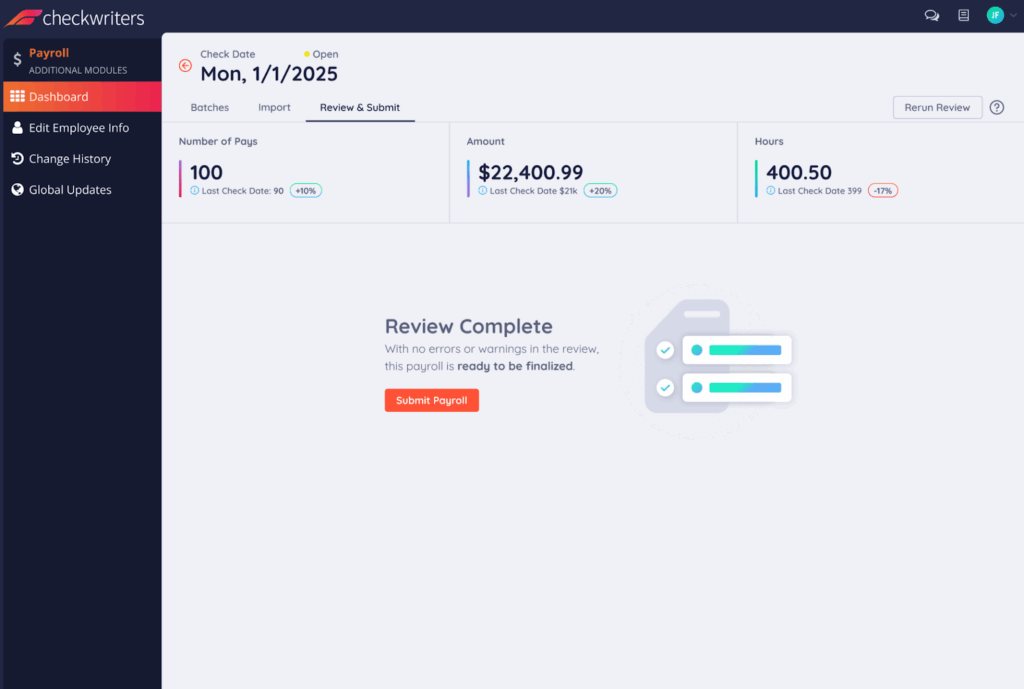

Is it simple for both administrators and employees?

Payroll should solve problems, not create new ones. Administrators need to run payroll and generate reports quickly, while employees need a self-service portal for pay stubs and updates. When either side struggles, time gets wasted.

Checkwriters supports both, giving admins powerful tools while employees get simple, independent access.

Do you know exactly what you’ll pay without surprise add-ons?

Hidden fees are one of the biggest frustrations with payroll providers. Some lure you in with a low rate but charge extra for filings or support, which strains tight nonprofit budgets.

You need a provider that’s upfront and predictable. At Checkwriters, pricing is transparent and all-inclusive, so there are no surprises.

Can it split salaries across multiple programs or funding sources?

Nonprofit payroll often has to follow the money. For example, a coordinator might split their time between a program funded by Grant A and another funded by Grant B. Funders expect reports that show this breakdown clearly.

A payroll system should make it easier to organize data so you can report staff time and costs in ways funders expect. Checkwriters offers reporting tools that simplify how payroll information aligns with your programs and grants.

Does it connect with your accounting or donor systems?

Chances are, you already use accounting or donor software to keep things organized. Without integration, you’ll spend hours re-entering data and risk errors along the way.

A payroll provider should connect seamlessly with the systems you already depend on. Checkwriters integrates directly with accounting and HR tools so you can cut out duplicate work.

Do they understand nonprofits, or just treat you like another small business?

Nonprofits have different payroll needs than other organizations.

You deal with exemptions, grant allocations, and detailed reporting that most small business payroll systems aren’t designed for. If your provider doesn’t understand these differences, you’ll constantly be working around their limitations. Checkwriters has decades of experience supporting nonprofits and offers payroll built with your world in mind.

Steps to Choosing a Nonprofit Payroll Provider

Now that you’re aware of what really matters in a payroll provider, let’s break down the steps that will help you make the right choice for your organization:

Step 1: Define your payroll snapshot

Start by getting clear on your own needs. How many people are you paying? Are they employees, contractors, or volunteers receiving stipends? Do you need to split salaries across multiple grants or programs? Do you have staff in different states with different tax rules?

A simple way to do this is to create a payroll snapshot—a one-page outline of who you pay, how you pay them, and any special requirements. For example:

- 2 full-time staff funded partly by restricted grants

- 1 part-time admin funded by general operations

- 3 contractors who need 1099s at year-end

- 1 staff member working across two programs that require salary splits

This doesn’t have to be complicated. A quick list or spreadsheet works just fine. The point is to see your reality clearly.

Step 2: Shortlist three providers, not ten

Once you have your payroll snapshot, use it as a filter. A clear picture of your needs makes it easier to cut through the noise. Instead of signing up for every demo that pops up in your search, narrow your list to the three providers that actually fit your nonprofit’s size, budget, and complexity.

For example, if your snapshot shows you need grant allocation, you can immediately rule out providers that don’t support it. If you rely heavily on contractors, cross off the systems that make 1099s an expensive add-on. If your staff is small and your budget is tight, remove enterprise-level systems designed for hundreds of employees.

With a tighter list, you’re not wasting time comparing endless features. You’re focusing on three serious contenders, and that gives you room to go deeper into what really matters.

Step 3: Ask nonprofit-specific questions

Once you’ve narrowed your list, it’s time to press for details. This is where the right questions make all the difference. Don’t be afraid to ask directly:

- Can salaries be split by grant or program?

- How are 501(c)(3) exemptions handled?

- Who is liable if tax filings are wrong?

- Can the system generate reports funders will accept?

- How is pricing structured for nonprofits with fluctuating staff or volunteers?

The way a provider responds will tell you everything. If they give vague or canned answers, it’s a sign they don’t specialize in nonprofit payroll. But if they can point to specific features, processes, and examples, you’ll know they’ve done this before—and that experience can save you costly mistakes.

Step 4: Test the experience

Don’t just take a provider’s word for it. See how their system works in real life. Sign up for a demo or, if possible, run a test payroll. Pay close attention to the basics we’ve already discussed: is the system intuitive for administrators, or does it feel like you’ll need hours of training? Can staff easily log in, check their pay stubs, or download tax forms without asking for help?

If the software feels clunky or confusing during a demo, it won’t magically improve once you’re locked into a contract. A good payroll system should feel natural to use from the start, saving time for both administrators and employees.

Step 5: Check peer reviews

Real-world feedback will show you what a demo never does. Go beyond the sales pitch and see what other nonprofits are actually saying. Scan reviews on platforms like Capterra, G2, or even nonprofit forums and LinkedIn groups where leaders share their experiences.

Pay close attention to complaints because they highlight the pain points you might run into yourself—like hidden fees, poor support, or clunky reporting. An easy way to speed this up is to search reviews for keywords such as “compliance,” “support,” or “fees.” Patterns will stand out quickly and give you a more honest picture of how the provider performs in the real world.

Why So Many Nonprofits Choose Checkwriters

We’ve worked with tons of non-profits over the years, and there’s something we hear all the time: “We didn’t realize how much time and stress payroll was costing us until we switched.”

For many of our clients, the story looks the same. They came to us after trying systems that were too generic, too expensive, or too confusing for their staff. What they wanted wasn’t bells and whistles—they wanted payroll that worked the way a nonprofit works.

Here’s what they found with Checkwriters:

- Compliance notifications and support features, so employers stay informed about deadlines and regulatory changes without added stress

- Flexible reporting features that help nonprofits organize payroll information in ways that support program and funder reporting

- Transparent pricing with no surprise add-ons

- Simple tools for administrators and a self-service portal for employees, cutting down on back-and-forth

- Support from people who know nonprofits and understand the difference between a charity and a small business

Conclusion

Choosing a payroll provider comes down to fit. The right one should match your staff size, your funding structure, and your compliance needs without adding stress.

There is no universal answer. What works well for one nonprofit might not work for another. But if you know your needs, ask the right questions, and focus on compliance, transparency, and ease of use, you’ll find a partner you can trust.

For many nonprofits, that partner is Checkwriters. So, get started with Checkwriters here.Disclaimer:The information contained herein is not intended to be construed as legal advice, nor should it be relied on as such. Employers should closely monitor the rules and regulations specific to their jurisdiction(s) and should seek advice from counsel relative to their rights and responsibilities.