Quick Summary

Gusto and SurePayroll both help businesses simplify payroll, but they serve different needs. Gusto shines as an all-in-one platform with HR tools, while SurePayroll appeals to smaller teams with straightforward payroll.

Gusto vs SurePayroll: Which One Should You Choose?

The days of juggling spreadsheets, chasing tax deadlines, and worrying about payroll compliance are over. Today, you can easily run payroll, stay compliant, and even handle HR with just a few clicks.

Two solutions that consistently make the shortlist are Gusto and SurePayroll. While both simplify payroll and HR, decision-makers want to know which one truly fits their team’s needs before committing.

So, this guide will walk you through the key differences in features, pricing, and support so you can choose with confidence.

Why Listen to Us?

We don’t just compare payroll software—we work with businesses that choose Checkwriters. Some came from tools that handled payroll but left gaps in HR. Others moved after struggling with compliance or support. Here’s what one client shared:

That’s why our perspective is rooted in what businesses actually experience. So, let’s get started.

Gusto vs SurePayroll: Key Differences

Gusto Offers a Broader Platform, SurePayroll Keeps It Focused

Gusto runs payroll and goes further by bringing HR tools, onboarding, benefits, and compliance into the same platform. For small businesses without a dedicated HR team, this all-in-one setup can feel like a major upgrade.

SurePayroll keeps things more focused. It handles payroll well with unlimited runs, tax filings, and direct deposits, leaving extras like HR and benefits as add-ons. That makes it a good fit for teams that only need payroll handled without the extra layers.

Gusto Puts Employees in Control, SurePayroll Covers the Basics

Employees love Gusto’s self-service features. From paycheck advances and savings goals to PTO requests and digital pay stubs, it gives staff more control and reduces back-and-forth with HR.

SurePayroll gives employees what they need to get by, with an online portal for pay stubs and tax forms, but it doesn’t go much further. For businesses that want to offer financial wellness tools, this difference stands out.

Gusto’s Interface Feels Modern, SurePayroll Gets Mixed Reviews

Gusto is often praised for how clean and intuitive it feels. Even first-time users say it’s easy to set up, navigate, and find what they need.

SurePayroll gets the job done, but reviews are mixed. Some find it simple, while others point out clunky steps when running off-cycle payroll or editing details. It’s functional, but not always smooth.

Gusto Builds Trust on Pricing, SurePayroll Draws Mixed Reactions

Gusto keeps pricing straightforward with clear tiers and no hidden fees. The flexibility to scale up or down without long-term contracts adds to the trust factor.

SurePayroll positions itself as affordable, and promotions like free months can be appealing. But user feedback often mentions surprise add-on costs or promotional rates that don’t match the actual bill, which leaves some feeling misled.

What Is Gusto?

Gusto is a cloud-based payroll and HR platform designed for small to mid-sized businesses.

It started as a payroll solution but has grown into an all-in-one people platform that covers hiring, onboarding, compliance, and even employee financial tools. The focus is on making payroll stress-free while giving employees easy access to their pay, benefits, and documents in one place.

Key Features

- Full-Service Payroll with automated tax filings, W-2s, and 1099s

- Employee Self-Service for pay stubs, tax forms, benefits, and PTO requests

- Time Tracking and Scheduling tools for clock-ins, holidays, and time-off requests

- Benefits Administration including health, dental, vision, 401(k), and HSAs

- Onboarding Tools with digital offer letters, document storage, and e-signatures

- Compliance Support with automated state and federal tax filings and reminders

- Employee Financial Tools such as paycheck advances, savings goals, and a Gusto Wallet app

Pricing

Gusto offers tiered pricing based on the level of HR support you need:

- Simple: $49/month covering core payroll and basic hiring tools for small businesses

- Plus: At $80/month, adds time tracking, next-day direct deposit, and more HR features

- Premium: $180/month with advanced HR, compliance, and dedicated support

Pricing is per month plus a per-employee fee. Gusto doesn’t require long-term contracts, which gives businesses flexibility to upgrade or downgrade as needed.

Pros and Cons

Pros

- Intuitive, modern interface that both admins and employees find easy to use

- Wide range of HR and compliance tools built into one platform

- Employee-focused features like advances, savings goals, and Gusto Wallet

- Transparent pricing with no hidden fees

- Strong customer support that is responsive and helpful

Cons

- More expensive than leaner payroll-only providers

- Customer support response times can slow during peak tax season

- May feel like “too much” for very small businesses that only want payroll

What Is SurePayroll?

SurePayroll is an online payroll service built with small businesses and household employers in mind.

It focuses on simplifying payroll by automating tax filings, direct deposits, and employee pay schedules while keeping costs affordable. Unlike broader HR platforms, SurePayroll keeps things lean, offering optional add-ons like benefits and HR tools if you need them.

Key Features

- Unlimited Payroll Runs with flexible scheduling (weekly, bi-weekly, monthly)

- Auto Payroll option to run payroll automatically each cycle

- Tax Filing Services including federal, state, and local filings with W-2s and 1099s

- Direct Deposit and Pay Stubs for employees and contractors

- Mobile Payroll Access so admins can run payroll on the go

- Optional Benefits Administration including 401(k), health insurance, and workers’ comp

- Household Payroll Services tailored for nannies and domestic staff

Pricing

SurePayroll positions itself as a budget-friendly option with straightforward pricing:

- Full-Service Payroll @ $29/month includes automatic tax filing and compliance handling

- Payroll Without Tax Filing @ $20/month where you handle your own tax filings

Pricing is monthly with a per-employee fee. Promotions such as free months for new customers are common, and you can scale features as you add employees.

Pros and Cons

Pros

- Affordable plans with clear monthly pricing

- Auto Payroll saves time for recurring pay cycles

- Flexible for small businesses, households, and nannies

- Easy-to-use mobile payroll app

- Option to start with payroll only and add HR/benefits later

- Highly rated customer reps by some users for responsiveness and setup support

Cons

- Support quality can be inconsistent, depending on who you reach

- Complaints about hidden fees and promotional pricing that feel unclear

- Fewer built-in HR tools compared to platforms like Gusto

- Limited reporting customization

Best Alternative to Gusto & SurePayroll: Checkwriters

While Gusto and SurePayroll both deliver solid payroll services, many businesses find themselves looking for a solution that blends modern technology with deeper service and compliance support. That’s where Checkwriters stands out.

Checkwriters is a full-service payroll and HR platform built for organizations that want more than just payroll automation. It combines intuitive software with expert service, helping businesses stay compliant, manage people, and streamline operations without the headaches of juggling multiple tools.

Key Features

- Full-Service Payroll with automated tax filings, direct deposits, and year-end forms

- HR Suite including applicant tracking, onboarding, and performance management

- Time and Attendance tracking with scheduling, PTO management, and mobile clock-ins

- Benefits Administration for health plans, retirement programs, and compliance reporting

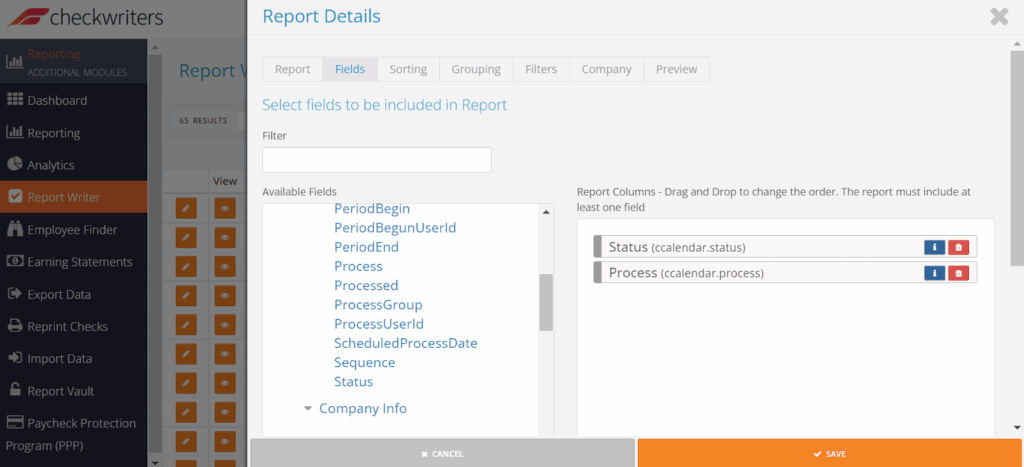

- Reporting & Analytics with customizable dashboards for payroll, HR, and finance data

- Compliance Support backed by a dedicated team of payroll and HR specialists

- Employee Self-Service Portal for pay stubs, tax forms, and benefit access

- Integrated Learning Management & Employee Engagement Tools to support workforce development

Pricing

Checkwriters offers customized pricing based on the size of your team and the services you need. Unlike some competitors, pricing is transparent, with no hidden fees or surprise add-ons. Businesses can scale services up or down, ensuring they only pay for what they use.

Pros and Cons

Pros

- Combines payroll, HR, time, and benefits in one platform

- Dedicated support team with compliance expertise

- Transparent, customized pricing with no hidden fees

- Scales easily for growing organizations

- Modern software paired with hands-on service

- Robust reporting and analytics for better decision-making

Cons

- No flat “one-size-fits-all” plan; pricing requires a custom quote

- May be more than very small businesses or households need if they only want basic payroll

Gusto vs. SurePayroll vs. Checkwriters: Feature Comparison

| Feature | Gusto | SurePayroll | Checkwriters |

| Payroll Automation | Full-service payroll with automated tax filings, W-2s, and 1099s | Unlimited payroll runs with Auto Payroll option | Full-service payroll with tax filings, direct deposit, and year-end forms |

| HR Tools | Built-in HR features (onboarding, compliance, org management) | Basic HR available as add-ons | Full HR suite: applicant tracking, onboarding, performance, compliance support |

| Benefits Administration | Health, dental, vision, 401(k), HSA integrations | Optional add-ons (health, 401(k), workers’ comp) | Integrated benefits management with compliance reporting |

| Time Tracking | Native time tracking and scheduling tools | Limited, mainly for payroll runs and PTO | Robust time and attendance with scheduling, PTO, and mobile clock-ins |

| Employee Self-Service | Pay stubs, tax forms, benefits access, Gusto Wallet | Employee portal for pay stubs and direct deposits | Self-service portal for payroll, benefits, tax forms, and training |

| Compliance | Automated tax filings and reminders | Handles filings, but with mixed user feedback on accuracy | Dedicated compliance support team plus automated filings |

| Reporting & Analytics | Basic reporting, limited customization | Standard payroll and tax reports | Advanced, customizable payroll + HR analytics dashboards |

| Support | Generally strong, responsive, but slower in peak season | Mixed reviews: some great reps, others poor consistency | Dedicated service team with compliance expertise |

| Pricing | Tiered (Simple, Plus, Premium) + per-employee fee | Transparent monthly + per-employee fee, DIY or full-service | Custom pricing, transparent, no hidden fees |

| Best For | Small to mid-sized businesses wanting payroll + HR in one | Small businesses, nannies, and households needing simple payroll | Organizations that want payroll + HR + compliance in one platform with expert support |

Why Do People Choose Checkwriters?

Dedicated Service and Compliance Expertise

Checkwriters doesn’t just give you software and leave you to figure it out. Every client has access to a dedicated support team that understands payroll, HR, and compliance inside and out.

This human element is especially valuable when regulations change or unique situations arise—something smaller businesses struggle with when using self-service-only platforms.

All-in-One Payroll and HR Platform

Unlike solutions that focus mostly on payroll, Checkwriters is built to manage the entire employee lifecycle. From recruiting and onboarding to benefits, scheduling, and performance management, everything lives in one system. This reduces the need for multiple vendors and keeps your data consistent across HR and finance.

Transparent, Flexible Pricing

One common frustration with payroll providers is surprise fees.

Checkwriters takes the opposite approach: pricing is customized to your needs and fully transparent, with no hidden costs. Businesses pay for the features they use, nothing more. As a result, it works for both growing organizations and established teams that want predictability in their budget.

Robust Reporting and Analytics

Payroll generates valuable data that leaders can use to make better decisions.

Checkwriters provides detailed, customizable reports across payroll, HR, and compliance. Leaders can track costs, monitor trends, and create reports that align with audits or strategic planning. This level of visibility is often limited or harder to customize on other platforms.

Employee-Friendly Experience

Checkwriters balances employer control with employee convenience. Through the self-service portal, staff can access pay stubs, tax forms, PTO balances, and benefits information anytime. This reduces HR bottlenecks and empowers employees to take ownership of their own data.

Scales With Your Business

As organizations grow, payroll and HR needs become more complex. Checkwriters is designed to scale without forcing you to rip and replace systems. Whether you’re adding locations, expanding benefits, or managing a larger workforce, the platform adapts. This gives it an edge over payroll-only tools.

Conclusion

Payroll isn’t one-size-fits-all. Gusto works well if you want payroll tightly integrated with HR features in a modern interface. SurePayroll appeals to smaller teams and households that value simple, affordable payroll.

Checkwriters brings both worlds together, offering modern software paired with dedicated support and compliance expertise. For organizations that want a long-term partner, not just a payroll processor, it’s often the more complete choice.Get started with Checkwriters today.