Quick Summary

Nonprofits may be exempt from federal income tax, but most still have to pay certain payroll taxes. The type and amount depend on the organization’s IRS classification, but FICA (Social Security and Medicare) almost always applies. FUTA (federal unemployment tax) is the major exception for qualifying 501(c)(3) organizations.

Nonprofits are Income Tax Exempt, But Does that Exempt Them from Payroll Taxes?

You might think that because nonprofits don’t pay federal income tax, they get a free pass on all other taxes. That’s not the case, especially when it comes to payroll taxes.

Whether you run a small community charity, a local church, or a nationwide nonprofit, there’s a good chance you still need to calculate, withhold, and file certain payroll taxes. Miss a step, and it could cost your organization both money and credibility.

Here, we’ll break down which payroll taxes apply to nonprofits, how the IRS classifies them, and how you can stay fully compliant.

Why Listen to Us?

At Checkwriters, we help nonprofits streamline payroll, stay compliant, and save valuable time for their mission. Our platform automates calculations and keeps records secure. Here’s a feedback from one of our clients.

When nonprofits tell us we’ve made payroll stress-free, we know we’re doing our job right.

What are Payroll Taxes?

Payroll taxes are taxes that employers and employees must pay based on wages and salaries earned. They’re used primarily to fund social programs like Social Security, Medicare, and unemployment insurance.

These taxes are generally grouped into two main categories:

1. Federal Insurance Contributions Act (FICA) Taxes

In the United States, FICA taxes consist of:

- Medicare tax: Helps fund federal Medicare health insurance programs, which provide hospital and medical benefits for people aged 65 and older, and certain younger individuals with disabilities.

- Social Security tax: Funds Social Security programs that provide retirement, disability, and survivor benefits.

Both employers and employees pay these taxes. For example, as of 2025, the Social Security tax rate is 6.2% each for employer and employee (on wages up to a certain limit), and the Medicare tax rate is 1.45% each with no wage cap. Additional Medicare taxes may apply to high earners.

2. Federal and State Unemployment Taxes (FUTA & SUTA)

These are typically paid only by employers.

- FUTA (Federal Unemployment Tax Act): A federal tax that helps fund unemployment benefits for workers who lose their jobs.

- SUTA (State Unemployment Tax Act): A state-level tax that also funds unemployment benefits, and may vary depending on the state and the employer’s history of claims.

The funds from FUTA and SUTA ensure that eligible unemployed workers receive temporary income while they search for a new job.

What Does the IRS Say About Nonprofits and Payroll Taxes?

According to the IRS, nonprofit organizations, also called exempt organizations, are generally exempt from federal income taxes under Section 501(c) of the Internal Revenue Code. However, this exemption does not automatically apply to payroll taxes.

If a nonprofit has employees, it is generally responsible for certain employment-related taxes. These include payroll taxes (FICA and FUTA) and other withholding obligations like federal income tax withholding.

- Federal Income Tax Withholding (FITW): Not technically a payroll tax, but the IRS requires nonprofits to withhold it from employees’ wages based on their Form W-4, using IRS guidance in Publications 15 and 15-A.

- Social Security and Medicare Taxes (FICA): Paid equally by employer and employee.

- Federal Unemployment Taxes (FUTA): Paid only by the employer from its own funds. Employees do not pay FUTA.

Nonprofits classified as 501(c)(3) organizations are automatically exempt from FUTA and cannot waive this exemption. Nonprofits that are not 501(c)(3) are subject to FUTA.

Payroll Taxes and Withholding Obligations for Nonprofits

Here’s a quick reference guide showing which taxes and withholdings apply to 501(c)(3) nonprofits versus other nonprofit organizations:

| Tax / Withholding Type | Payroll Tax? | Applies to 501(c)(3) Nonprofits? | Applies to Non-501(c)(3) Nonprofits? | Who Pays? |

| Federal Income Tax Withholding (FITW) | No (but required) | Yes | Yes | Employee (withheld by employer) |

| Social Security Tax (FICA) | Yes | Yes | Yes | Employer & Employee (equal share) |

| Medicare Tax (FICA) | Yes | Yes | Yes | Employer & Employee (equal share) |

| Federal Unemployment Tax (FUTA) | Yes | No | Yes | Employer only |

| State Unemployment Tax (SUTA) | Yes (state-level) | Yes* | Yes | Employer only |

*Some states exempt certain nonprofits from SUTA. Check local laws.

Types of Organizations That Qualify as Nonprofits

The IRS recognizes several types of organizations as tax-exempt nonprofits, depending on their purpose and how they are structured. While Section 501(c)(3) charitable organizations are the most widely known, other categories also exist under the Internal Revenue Code.

1. Charitable Organizations (501(c)(3))

These are organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes. They must also meet additional IRS requirements to maintain tax-exempt status.

2. Churches and Religious Organizations

Churches, synagogues, mosques, and other religious institutions, along with certain religious organizations, can qualify for exemption under Section 501(c)(3) if they meet the applicable IRS requirements.

3. Private Foundations

Any organization that qualifies for 501(c)(3) status is automatically considered a private foundation unless it meets an exception under Section 509(a). Private foundations often receive funding from a single source, such as one family or corporation, and primarily make grants to other charitable organizations or individuals rather than operating their own programs.

4. Political Organizations (Section 527)

These include parties, committees, associations, funds, or other entities formed and operated mainly to accept contributions or make expenditures for political purposes. They are tax-exempt for certain political activities but have different reporting and compliance rules than 501(c)(3) charities.

5. Other Nonprofits

Some organizations qualify for tax exemption under other subsections of the Internal Revenue Code. Examples include social welfare organizations, civic leagues, social clubs, labor organizations, and business leagues. These groups have different purposes and requirements than charitable nonprofits.

How to Stay Compliant with Payroll Taxes as a Nonprofit

Nonprofit status doesn’t excuse organizations from following payroll tax rules, and compliance mistakes can lead to costly penalties, IRS audits, and loss of credibility. Here’s how to avoid these mistakes and stay compliant.

1. Understand Your Tax Obligations

Confirm which payroll taxes apply to your organization, such as FICA (Social Security and Medicare), FUTA/SUTA, and federal income tax withholding, based on your IRS classification. For example, 501(c)(3) nonprofits are exempt from FUTA but still must handle FICA and often SUTA.

2. Keep Accurate Employee Records

Maintain up-to-date employee information, including Form W-4, employment eligibility verification, and any state-specific forms. With Checkwriters, you can store all HR forms digitally in the Document Center, collect electronic signatures compliant with the ESIGN Act, and access them instantly during an audit.

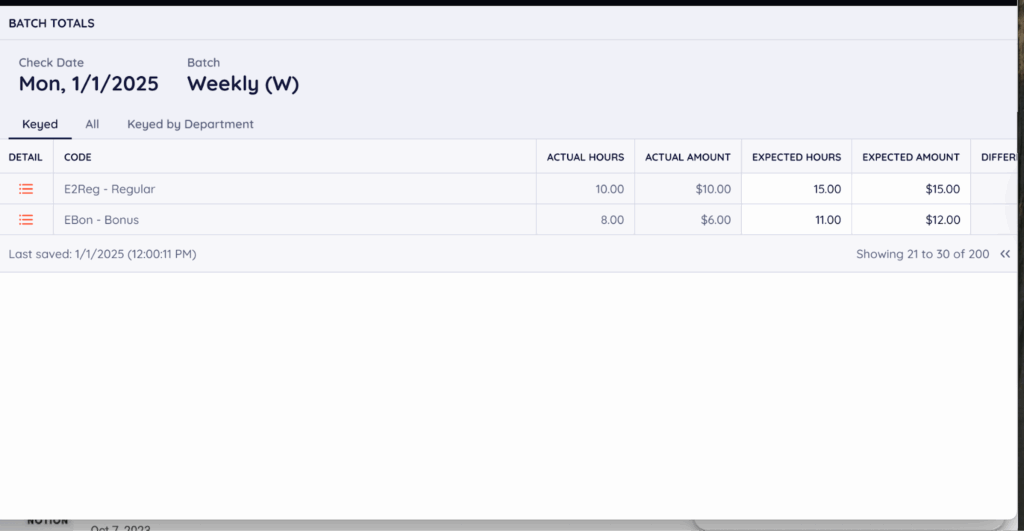

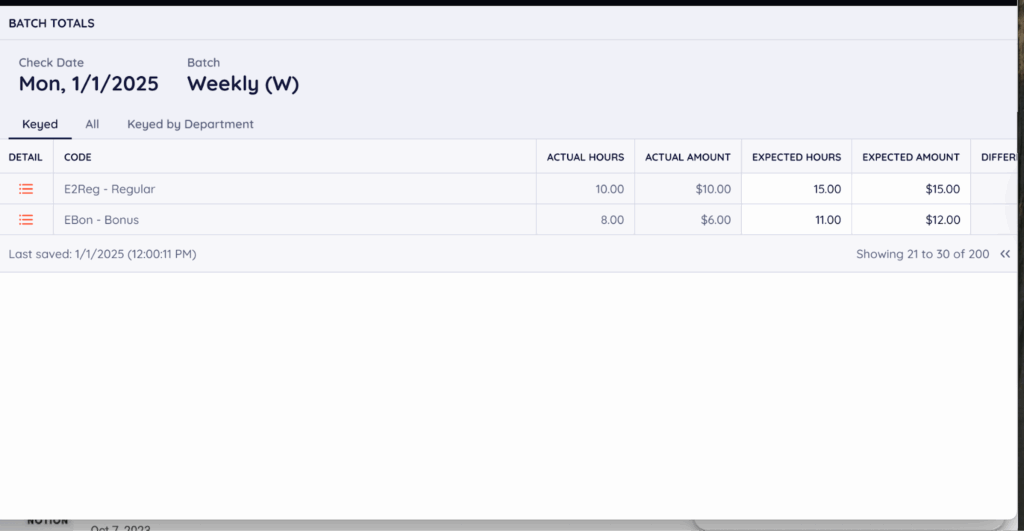

3. Calculate and Withhold Correctly

Ensure payroll tax rates are applied correctly to each employee’s wages, including any applicable limits (such as the Social Security wage base). Miscalculations can result in underpayment penalties. Checkwriters’ payroll engine applies current rates automatically, removing the guesswork.

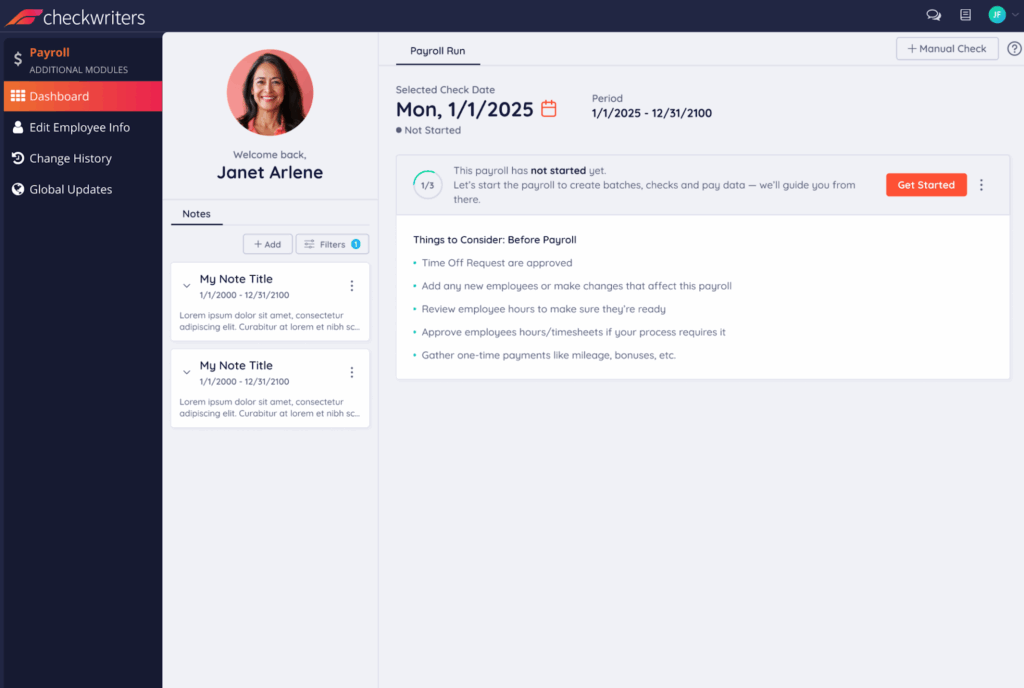

4. File and Deposit on Time

IRS deadlines for Forms 941, 940, and electronic tax deposits are strict. Late filings or payments can quickly add up in penalties, even for nonprofits. Checkwriters automates your filings, submits deposits through EFTPS, and sends reminders so nothing slips through the cracks.

5. Manage Compliance Beyond Payroll

Payroll compliance often overlaps with HR compliance, especially for nonprofits managing diverse teams. With Checkwriters’ ACA Dashboard and compliance tools, you can track Affordable Care Act reporting, store OSHA, FMLA, and ADA forms electronically, and receive real-time compliance alerts.

6. Use a Trusted Payroll and HR Partner

Manual tracking can be risky and time-consuming. Checkwriters combines payroll, compliance, and HR management in one paperless platform, so you can:

- Calculate FICA, SUTA, and applicable local taxes automatically

- Flag FUTA exemptions for 501(c)(3) organizations

- Approve time-off requests in a clean calendar view without separate spreadsheets

- Keep all tax forms, policies, and HR documents in one secure system

With Checkwriters, nonprofits can focus more on their mission and less on decoding tax forms or worrying about deadlines.

Do Nonprofits Pay Payroll Taxes?

The short answer is yes—nonprofits do pay payroll taxes.

While qualifying 501(c)(3) nonprofits are exempt from federal unemployment taxes (FUTA), they still must handle Social Security and Medicare taxes (FICA), state unemployment taxes in many states (SUTA), and withhold federal income tax from employees’ paychecks. Nonprofits that are not 501(c)(3) are subject to the same payroll tax rules as for-profit businesses.

However, knowing the rules is one thing, but keeping up with them is another. Filing deadlines, rate changes, and recordkeeping requirements can quickly pull focus from your mission. That’s where Checkwriters comes in, with automated tax calculations, compliance alerts, and secure electronic records. This way, payroll stays accurate and your team stays focused on impact.Explore Checkwriters today.