Quick Summary

Managing payroll in a nonprofit comes with unique challenges from grant-funded salary tracking to strict compliance requirements. This guide reviews the 7 best payroll software options for nonprofits, comparing features, pricing, and use cases to help you choose the right fit.

What’s the Best Payroll Solution for Your Nonprofit?

The moment your team grows past 30, 40, or even 50 employees, you quickly realize that manual spreadsheets or outdated payroll systems just won’t cut it anymore.

Whether you’re upgrading to payroll software for the first time or switching to a solution that better fits your needs, you’ve landed in the right place.

We’ve carefully reviewed and compared the top options to bring you our list of the 7 best payroll software for nonprofits to save time, stay compliant, and focus on your mission.

Why Listen to Us?

We’ve worked with thousands of nonprofits at Checkwriters, helping them take the stress out of payroll. We understand the challenges of managing multiple pay schedules, keeping up with changing regulations, and getting it right every time.

What to Look for in a Non-Profit Payroll Software

Nonprofits have unique payroll needs, from reporting tax-exempt status to tracking grant-funded salaries. The right software should address these requirements head-on and make payroll stress-free. Here’s what to prioritize:

Payroll Tax Compliance

A good system automatically calculates and files all required payroll taxes while staying up to date with changing federal and state regulations. This helps reduce the risk of costly errors and late filings.

Tax-Exempt Status Reporting

Maintaining your nonprofit’s IRS tax-exempt status requires precise reporting. Your payroll software should generate nonprofit-specific compliance reports that make it easy to meet these requirements and satisfy your board’s oversight responsibilities.

Multi-Schedule & Role Support

Many nonprofits have a mix of employees: full-time staff, part-timers, seasonal workers, and stipended volunteers. Your payroll system should handle multiple pay schedules and pay types in one place, avoiding the complexity of separate systems.

Grant-Funded Salary Tracking

The ability to tag and track salaries against specific grants or funding sources is essential. This feature ensures you can produce clear reports for donors, grantors, and auditors. This way, it is easy to show exactly how funds were used without manual spreadsheets.

Easy-to-Use Employee Portals

A self-service portal empowers staff to view pay stubs, download tax forms, and update personal information on their own, cutting down on admin requests and freeing your HR team to focus on higher-value work.

7 Best Payroll Services for Non-Profits

| Software | Best For | Key Features |

| Checkwriters | Nonprofits needing deep compliance & HR integration | Ttax-exempt reporting, automated payroll & benefits, self-service portals |

| Gusto | Small to mid-sized nonprofits wanting ease of use | Automated tax filing, benefits management, contractor payments, integrations |

| OnPay | Nonprofits needing affordability & simplicity | Payroll tax filing, benefits, volunteer stipend payments, multi-schedule support |

| Paychex | Larger nonprofits with complex HR needs | Scalable payroll, 24/7 support, compliance, benefits admin |

| ADP | Nonprofits needing all-in-one HR + payroll | Automated payroll, HR tools, compliance, recruiting |

| APS | Nonprofits with multi-location staff & funding sources | Automated payroll, grant tracking, multi-schedule support, audit-ready reports |

| Paylocity | Nonprofits wanting advanced employee engagement + payroll | Payroll automation, time tracking, Form 990 prep, diversity reporting |

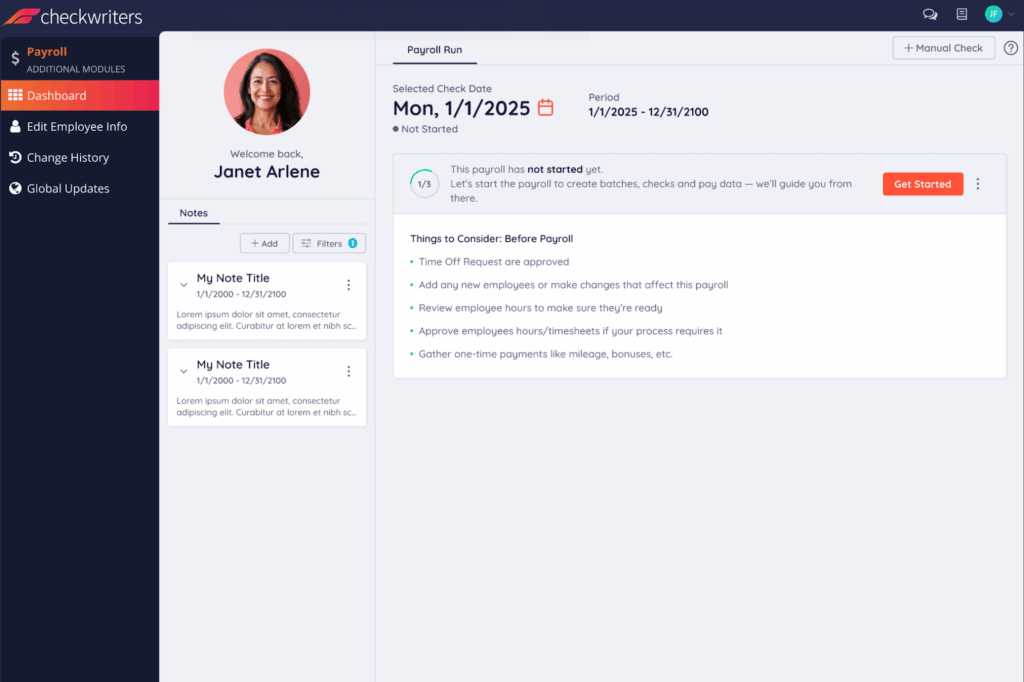

1. Checkwriters

Checkwriters HR and payroll software helps nonprofit organizations manage payroll, compliance, and human resources with ease and efficiency.

Checkwriters is designed with nonprofit operations in mind. You don’t have to worry about audits, fines, or compliance errors. We calculate and file payroll taxes, generate IRS-ready reports, and keep your organization updated on the latest changes in labor laws and nonprofit regulations.

Checkwriters also creates a smoother experience for both employers and employees. Employers can automate all manual tasks while employees have access to a secure self-service portal where they can view pay stubs, download tax forms, update personal information, and track benefit contributions.

Whether you’re a small community nonprofit or a large multi-state organization, Checkwriters scales to fit your needs.

Key Features

- Automated Payroll Processing: Ensures accurate, on-time payments for all employees while eliminating manual calculations.

- Comprehensive Compliance Tools: Automatically calculates and files payroll taxes, generates IRS-ready reports, and keeps your organization updated on the latest labor laws and nonprofit regulations.

- Centralized Employee Data: Stores personal details, PTO, performance records, and benefits in one secure platform.

- Streamlined Recruiting & Onboarding: Posts jobs to 100+ boards, tracks applicants, and automates onboarding workflows.

- Employee Self-Service Portal: Employees can view pay stubs, download tax forms, update personal information, and track benefit contributions without contacting HR.

- Seamless Integrations: Works with your existing accounting and HR systems to maintain data consistency.

- Top-Tier Security: Uses advanced encryption and protocols to protect sensitive payroll and HR data.

Pros

- Widely praised for responsive, personal customer service.

- Scales easily for nonprofits of any size, including multi-state payroll.

- Automates time-consuming HR and payroll tasks.

- Nonprofit-focused reporting simplifies audits and compliance.

- Smooth implementation with a dedicated onboarding team.

Cons

- Knowledge base could benefit from more built-in guides and reports.

- Based in the US

2. Gusto

Gusto offers a user-friendly payroll and HR solution designed to simplify nonprofit operations from hiring and onboarding to benefits management and tax compliance.

This cloud-based platform brings together tools like automated tax filings, compliance alerts, contractor management, and performance tracking in one place to save time and reduce administrative headaches.

You’ll also have access to a dedicated support team and a rich resource library to ensure that you can quickly find answers and guidance whenever you need it.

Key Features

- Automated Payroll & Tax Filing: Runs payroll and automatically files federal, state, and local taxes (including FUTA), helping you stay compliant without extra effort.

- All-in-One HR Platform: Manage job postings, applicant tracking, onboarding, time tracking, PTO, and benefits from one dashboard.

- Employee Self-Service: Staff can view paychecks, tax forms, and benefits, submit time-off requests, and update personal details from any device.

- Contractor-Friendly: Pay both W-2 employees and 1099 contractors without extra setup fees; contractors can self-onboard and receive automated payment alerts.

- Integrations for Nonprofits: Connects with tools for finance, donor management, and operations to centralize workflows.

- Engagement & Retention Tools: Includes new hire welcome emails, birthday reminders, goal tracking, and performance review features.

- Compliance & Expert Support: Offers proactive compliance alerts, a best-in-class support team, and resources like how-to guides and tax law updates.

Pros

- Easy-to-use interface (both web and mobile).

- Saves time with automated payroll, tax filings, and HR workflows.

- Offers contractor management without extra fees.

- Includes employee engagement features like goal tracking and recognition tools.

- Dedicated support team with SHRM- and HRCI-certified experts.

Cons

- Some web features aren’t available in the mobile app (e.g., certain forms, goal tracking).

- Occasional issues with logging users out unexpectedly or loading delays.

- Certain custom workflows and integrations can feel rigid for advanced users.

3. OnPay

OnPay delivers full-service payroll and HR tools for nonprofits, charities, and 501(c)(3) organizations.

OnPay combines accurate payroll with integrated HR features to help nonprofits save time, stay compliant, and give staff easy access to the information they need. With over 30 years of industry experience, they understand the unique compliance needs of nonprofits, from handling FUTA exemptions to managing a mix of W-2 employees, 1099 contractors, volunteers, and board members.

They are also recognized for their hands-on support, so whether you’re a small local charity or a multi-state nonprofit, you get expert help every step of the way to make payroll stress-free.

Key Features

- Nonprofit-Specific Payroll Expertise: Handles FUTA exemptions for 501(c)(3) organizations and ensures compliance with federal and state tax regulations.

- Full-Service Payroll: Run payroll in just a few clicks from any device; manage multiple pay rates, overtime, and flexible permissions.

- Unlimited Pay Runs: Pay staff, contractors, volunteers, and board members as often as needed without extra fees.

- Integrated HR Tools: Includes PTO management, automated onboarding, e-signatures, and secure document storage in the cloud.

- Employee Self-Service: Staff can onboard themselves, view pay stubs, and update personal details from their own account.

- Accounting & Time Tracking Integrations: Syncs with leading tools like QuickBooks and Xero to keep the books organized.

Pros

- Designed with nonprofits in mind, including grant funding separation and FUTA exemptions.

- Unlimited pay runs in any state at no extra cost.

- Competitive pricing with no hidden fees.

- Integrates smoothly with popular accounting and time tracking software.

- Highly responsive customer service team.

Cons

- Onboarding process can feel drawn-out compared to some competitors.

- QuickBooks integration works well but may require manual adjustments for tax transaction categorization.

4. Paychex

Paychex provides nonprofits with an all-in-one HR and payroll platform designed to simplify compliance, automate payroll, and support employee management.

Nonprofits can manage payroll, HR, benefits, tax filings, and reporting in one place through the Paychex Flex® platform, which scales to fit organizations of any size.

It comes with features like integrated benefits administration, an HR library, and an employee handbook builder to streamline processes, reduce administrative workload, and keep your nonprofit compliant.

Key Features

- Full-Service Payroll & Tax Filing: Automates payroll calculations, tax withholdings, filings, and payments to federal, state, and local agencies.

- Integrated HR Tools: Includes onboarding, employee training, handbook creation, and a robust HR resource library.

- Benefits Administration: Offers retirement plans, health insurance options, and other benefits to help nonprofits attract and retain staff.

- Compliance Support: Helps navigate complex IRS and labor regulations, reducing the risk of penalties.

- Custom Reporting & Analytics: Build tailored payroll and HR reports to track expenses, trends, and compliance metrics.

- Employee Self-Service: Staff can view pay stubs, manage benefits, request PTO, and access tax forms online.

Pros

- Comprehensive HR + payroll platform in one system.

- Flexible processing options and online access from any device.

- Strong benefits administration offerings, including retirement and health plans.

- Compliance tools and resources designed to reduce regulatory risks.

- Option to work with a dedicated account manager under certain plans.

Cons

- Customer service quality can be inconsistent, with mixed user reviews ranging from excellent to poor.

- Occasional delays or disruptions in payroll processing reported by some users.

5. ADP

ADP offers an all-in-one payroll and HR platform built to help nonprofits stay focused on their mission.

Their platform supports everything from automated payroll processing and benefits administration to compliance guidance and HR outsourcing. Organizations have access to recruiting tools, employee engagement resources, and flexible payment options that cater to different workforce needs.

One standout feature of ADP is its Marketplace — a library of apps and integrations where nonprofits can add specialized tools for accounting, time tracking, onboarding, and more.

Key Features

- Automated Payroll & Tax Filing: Handles payroll calculations, deductions, and filings for federal, state, and local taxes.

- Compliance Management: Provides guidance on IRS exemptions, FLSA protections, and other nonprofit-specific regulations.

- Benefits Administration: Offers access to health plans, retirement options, and other benefits to attract and retain talent.

- Recruitment & Talent Management: Includes tools for hiring, onboarding, and workforce analytics.

- Flexible Payment Options: Pay employees via direct deposit, paper checks, or Wisely® pay cards.

- Custom Integrations via ADP Marketplace: Connects with accounting, ERP, and HR apps for a tailored workflow.

- HR Outsourcing Services: Access live HR support, handbook builders, compliance alerts, and legal assistance through select packages.

Pros

- Comprehensive set of payroll, HR, benefits, and compliance tools in one platform.

- Scalable packages for nonprofits of all sizes.

- Flexible payment methods and strong accounting integrations.

- Access to a large app marketplace for extended functionality.

- Well-established brand with experience serving nonprofit organizations.

Cons

- Occasional issues with software bugs or outdated interface elements.

- Implementation challenges and delays reported by some organizations.

6. APS

APS combines powerful automation with human-first customer service to deliver payroll and HR solutions tailored for nonprofits.

This platform enables nonprofit organizations to focus on their mission by automating payroll tax compliance, managing volunteers, and simplifying staff administration. It also supports grant allocations, labor cost tracking, and advanced reporting to help organizations meet funding and audit requirements with ease.

You don’t have to worry about outgrowing the system, as APS can scale to handle everything from small local teams to multi-state operations, while keeping processes streamlined and compliant.

Key Features

- Nonprofit-Specific Payroll & HR: Manage payroll taxes, grant allocations, labor distribution, and benefits in one centralized system.

- Payroll Tax Compliance: Certified payroll tax experts ensure accurate filings and help maintain 501(c)(3) status.

- Grant & Labor Tracking: Track employee hours tied to grants for more accurate budgeting and overhead management.

- Worker Classification Management: Handle employees, contractors, and volunteers with built-in tools for FLSA compliance.

- Benefits Administration: Offer online open enrollment and carrier connections to streamline benefits management.

- Robust Reporting & Analytics: Access dashboards and custom reports for payroll, overtime, turnover, and more.

- Seamless Integrations: Connect with accounting, general ledger, and 403(b) systems to maximize efficiency.

- Dedicated Support Team: Assigned specialists respond quickly, with lifetime training and resources included.

Pros

- Tailored features for nonprofits, including grant and volunteer tracking.

- Outstanding customer service with dedicated account teams.

- Consolidates multiple HR functions into one platform.

- Strong compliance tools for complex nonprofit payroll needs.

Cons

- Some bulk actions and document uploads still require manual steps.

- Mobile admin interface could be more user-friendly.

7. Palocity

Paylocity provides nonprofits with a unified HR and payroll platform designed to reduce admin work and keep compliance in check.

It automates payroll, time tracking, and reporting, while offering nonprofit-specific tools like grant expense tracking and Form 990 preparation.

Like checkwriters, employees get a self-service portal for pay stubs, schedules, and tax forms, while administrators gain access to compliance dashboards, diversity reporting, and mobile time tracking.

Key Features

- Grant-Linked Payroll Tracking: Track time spent on grant-related work and generate accurate expense reports for audits or funder requirements.

- Payroll Tax Compliance: Withhold FITW and FICA correctly, prepare and file Form 990, and stay compliant with nonprofit tax regulations.

- Self-Service Portals: Give staff easy access to pay stubs, tax documents, schedules, and HR forms without extra admin involvement.

- Time & Attendance Management: Replace paper timesheets with mobile, web, or kiosk clock-in options while enforcing compliance rules for worker classification and scheduling.

- Compliance Resources: Access EEO, FLSA, and industry-specific guidance, plus training courses to reduce compliance risk.

- DEIA & Employee Engagement Tools: Run anonymous surveys, monitor workforce diversity metrics, and support bias-free hiring practices.

- Expert Support & Liability Protection: Rely on Paylocity’s promise to assume liability for penalties or interest caused by their payroll errors.

Pros

- Comprehensive HR + payroll functionality in one system.

- Strong grant tracking and nonprofit tax compliance tools.

- DEIA-focused hiring and engagement features not common in other platforms.

- Liability coverage in case of payroll errors by Paylocity.

Cons

- Requires training to fully leverage advanced analytics and DEIA tools.

- Some reviewers mention the interface could be more intuitive.

Conclusion

Managing payroll in a nonprofit comes with unique challenges, from grant-funded salary tracking to strict compliance requirements. The right solution should simplify processes, keep you audit-ready, and free up time for your mission. Among the top options available, Checkwriters stands out for its nonprofit-specific features and reliable support.

Get started with Checkwriters today.